PAY ATTENTION TO BITCOIN WHEN THE WORLD IS FALLING APART.

Every major global crisis has pushed more people toward #Bitcoin.

2009: Financial crisis → Genesis Block

2013: Cyprus bank haircuts → Bitcoin surges

2020: Pandemic fear → +416%

2025: You are here.

The history matters.

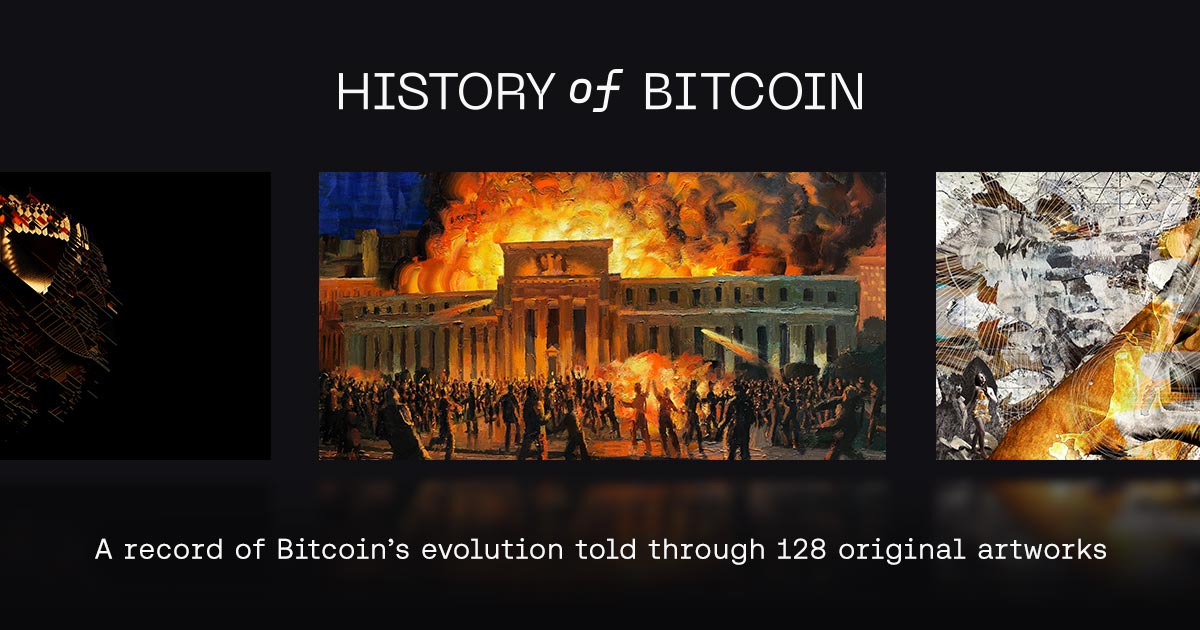

While Wall Street was burning in 2008, #SatoshiNakamoto was quietly building an exit. As the global financial system cracked under the weight of reckless lending, collapsing banks, and evaporating trust, #Satoshi was assembling a new kind of monetary architecture, one that didn’t depend on the stability or honesty of financial institutions.

The crash began long before Lehman Brothers fell.

In early 2007, New Century Financial collapsed under subprime defaults. HSBC announced a $10.5B write-down. Bear Stearns froze withdrawals in its mortgage-backed hedge funds. The warning signs were there, but few listened.

By 2008, the dominos fell fast:

Bear Stearns collapsed, Lehman Brothers died after 158 years, credit markets froze, and panic spread globally. Governments rushed in with bailouts while the public watched trust evaporate.

During this period, #Satoshi was finalising the #BitcoinWhitepaper, opening with a simple idea and ending with a powerful message: electronic payments without relying on trust.

Satoshi had started working on Bitcoin in mid-2007, around the exact time “bank run” re-entered common vocabulary. The timing wasn’t an accident. He recognised the need for a monetary system that couldn’t be manipulated, frozen, or debased by failure-prone institutions.

On August 22, 2008, as markets were deteriorating further, he contacted Wei Dai to reference the earlier “b-money” concept. Bitcoin was nearing completion just as the traditional system was in freefall.

Then came the statement that immortalised the moment:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Embedded forever in Bitcoin’s Genesis Block, a timestamped reminder that Bitcoin was born from a crash.

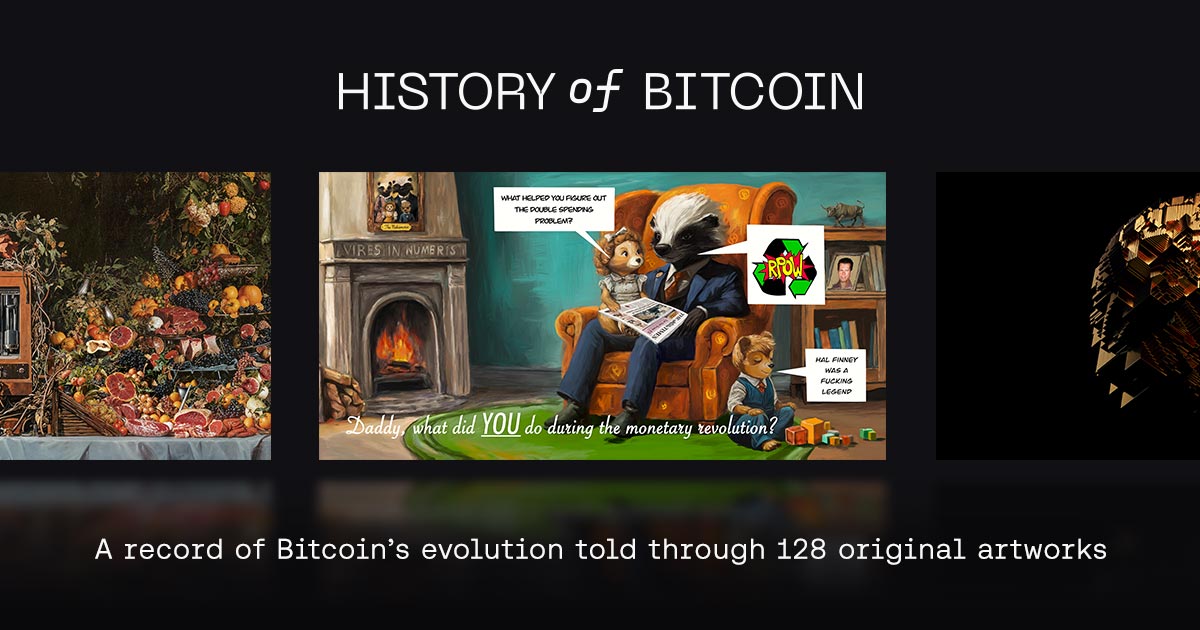

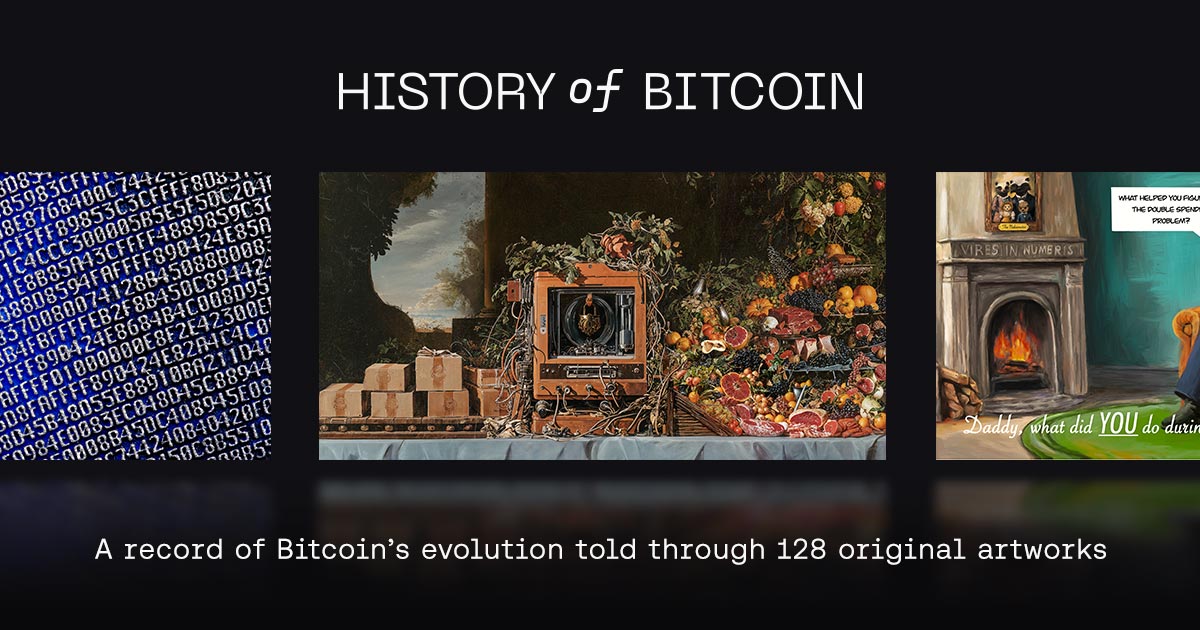

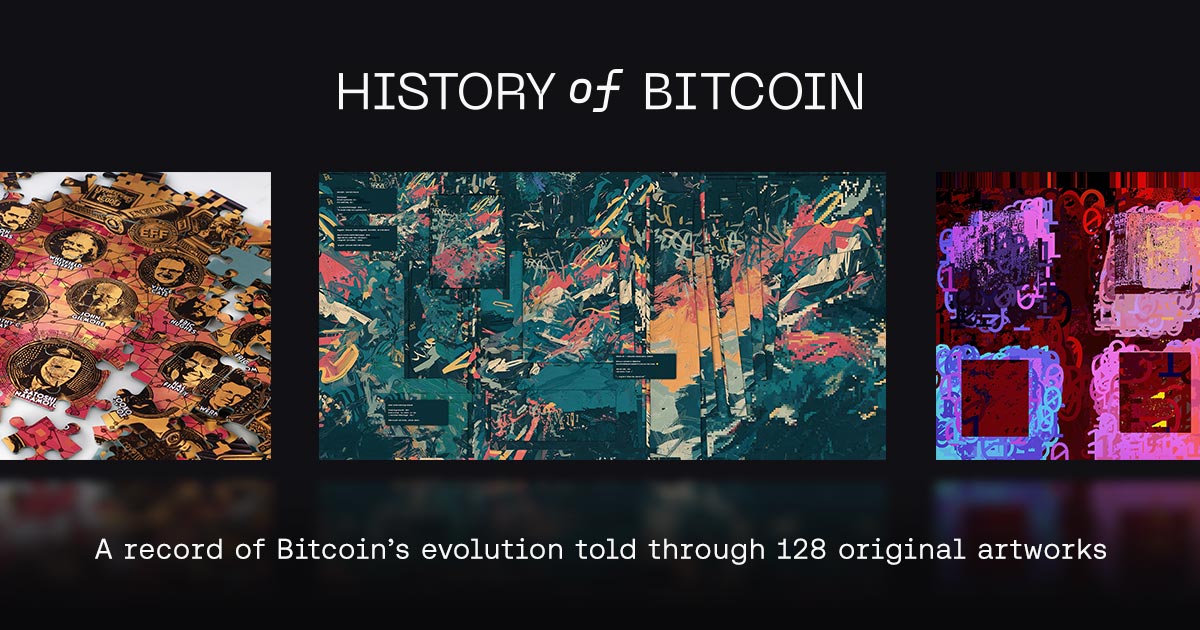

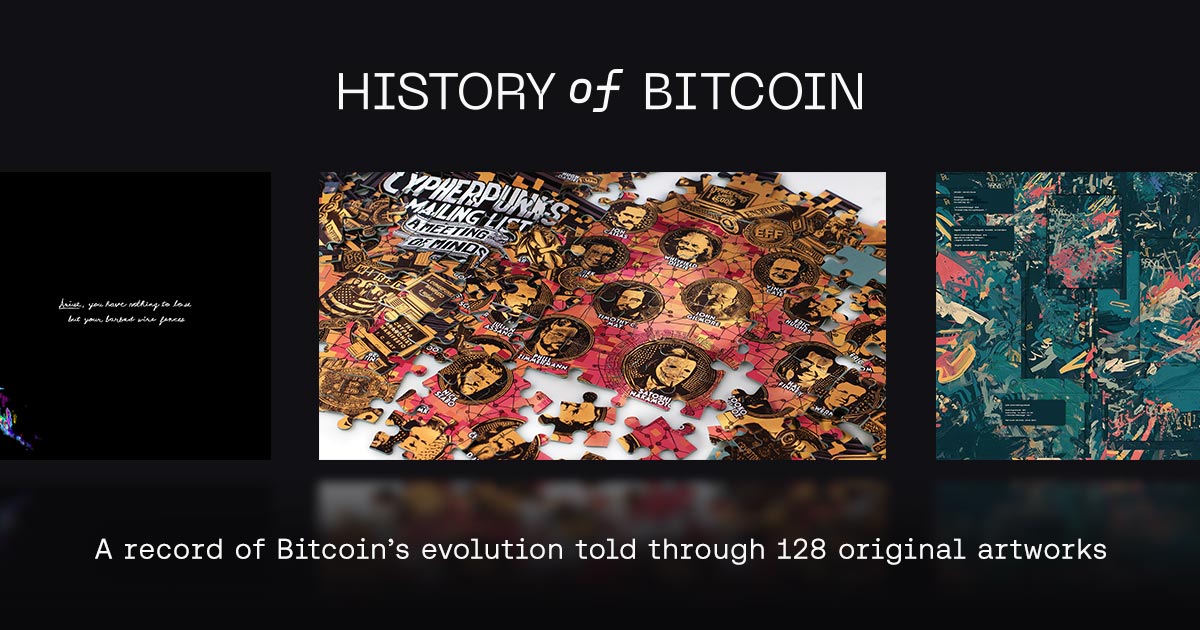

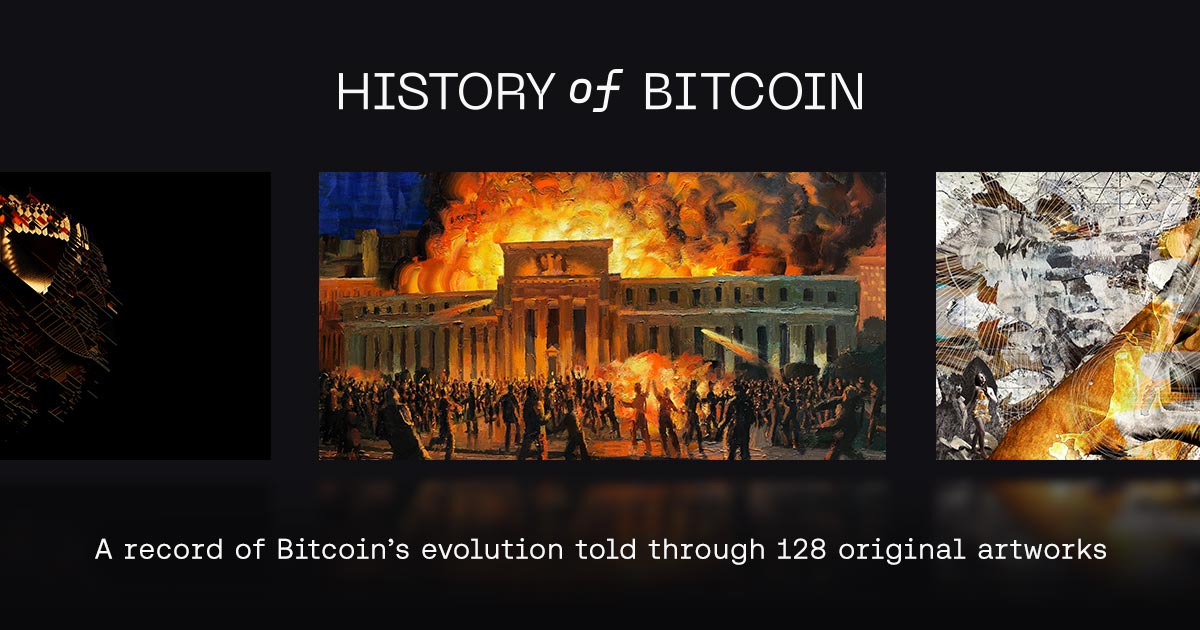

We capture this pivotal chapter in “The History of Bitcoin by Smashtoshi,” accompanied by artwork from Alex (@paintwithalex over on X). It appears in the History of Bitcoin Collector’s Book and on our interactive timeline.

Read the full article:

History of Bitcoin

It Began With a Crash

As Satoshi built Bitcoin in 2008, the global financial crisis hit. Bank bailouts and recession fuelled public mistrust, amplifying Bitcoin’s purp...