📍🇸🇱 Government of Sierra Leone has put forward its National Blockchain Strategy

The Government of Sierra Leone, through the Ministry of Communication, Technology and Innovation (MoCTI), has signed a Memorandum of Understanding (MoU) with the SIGN Foundation to develop blockchain-powered national digital systems aimed at accelerating the country’s digital transformation.

The next step is to develop a Strategic Implementation #Roadmap to guide the rollout of the initiatives, with key priorities including a #National Digital Identity Infrastructure, Digital Wallet Integration, Blockchain-enabled Payment Systems, and an Asset Tokenisation #Framework.

The partnership is part of Sierra Leone’s broader strategy to position itself as a regional hub for emerging technologies, particularly in #blockchain and Artificial Intelligence, while enhancing transparency, financial #inclusion, and the delivery of #public services.

The Ministry of Communication, Technology and Innovation will provide policy guidance and regulatory oversight to ensure that all initiatives align with the national digital agenda.

Felei TechCity, the government’s innovation hub, will serve as the central point for project coordination and implementation.

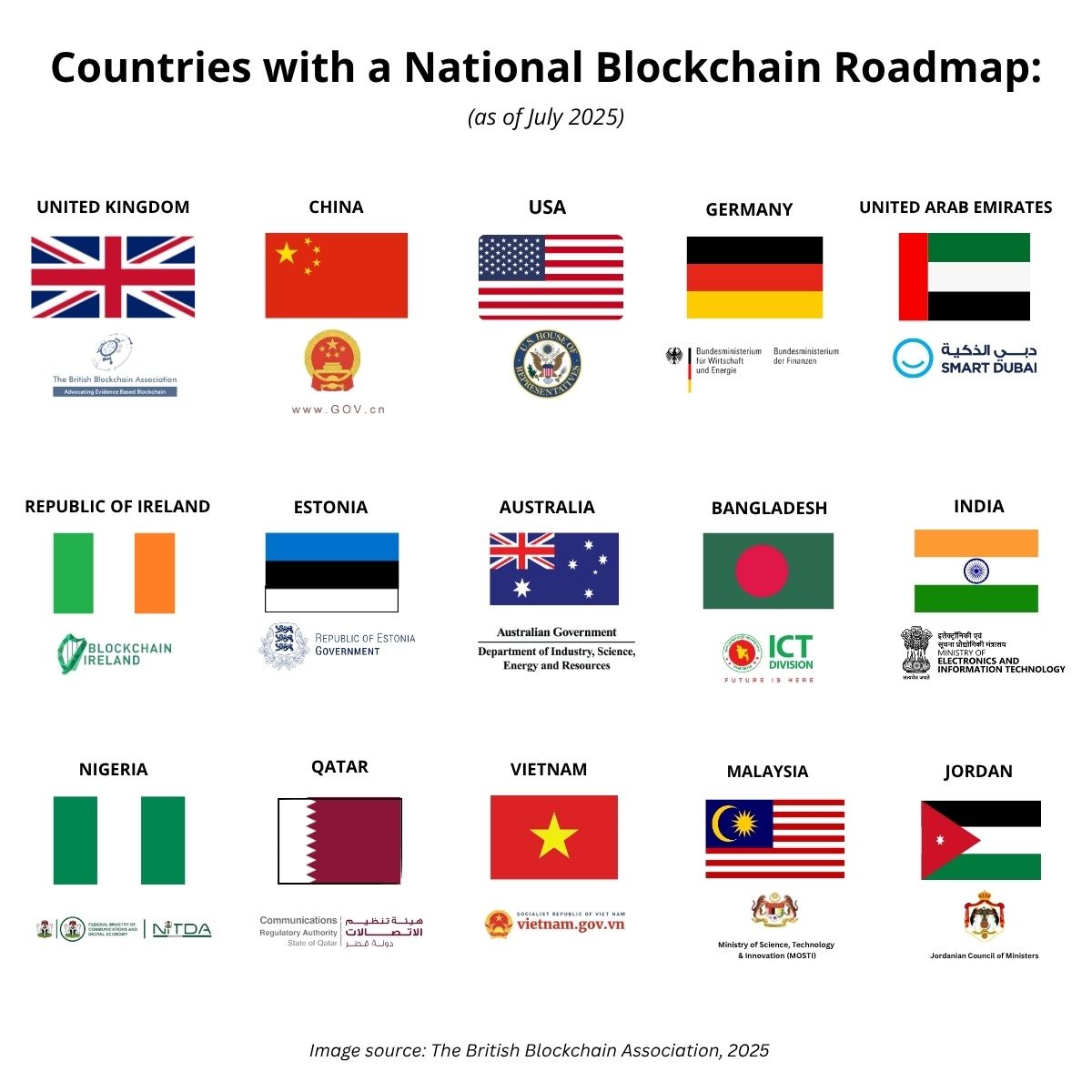

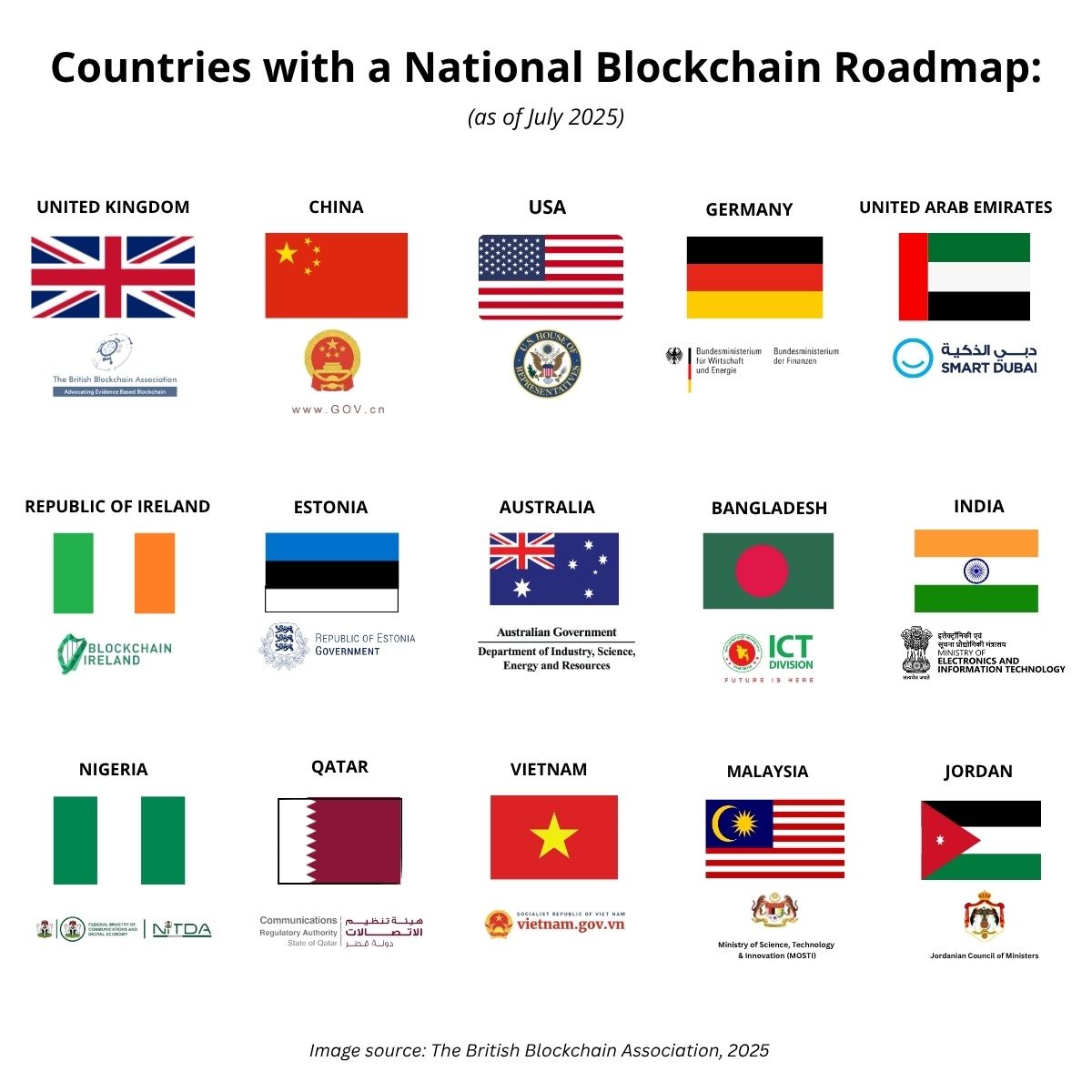

➡️ Only 15 countries in the world have so far put forward their NBR, with Sierra Leone now set to become the 16th on this list:

X (formerly Twitter)

The British Blockchain Association (@Brit_blockchain) on X

🇺🇸 With the U.S House of Representatives passing the American Blockchain Act, the number of countries with a dedicated national-level Blockch...

#National #Blockchain #Roadmap