2024 is almost over! And what a year it has been! 📅

Until we look back, it's easy to forget just how far we've come in so short a time.

Here are the 5 most pivotal events in the Bitcoin space during 2024, and how they changed Bitcoin's future forever: 👇

1️⃣ On 𝟭𝟭 𝗝𝗮𝗻𝘂𝗮𝗿𝘆, the first U.S. Bitcoin Exchange-Traded Funds (ETFs) were approved

For the first time, mainstream investors could add Bitcoin to their portfolios through the same platforms they use for stocks and bonds. No wallets, private keys, or exchanges—𝘫𝘶𝘴𝘵 𝘤𝘭𝘪𝘤𝘬 𝘢𝘯𝘥 𝘣𝘶𝘺. 🖱️

Sure, this isn’t the sovereign individual approach to stacking sats, but everyone has to start somewhere, right?

The result has been a tidal wave of institutional demand, and more FOMO from retail buyers. 🌊

But the most important part isn't the price; it's the fall of the next domino on Bitcoin's path to global adoption.

1️⃣ On 𝟭𝟭 𝗝𝗮𝗻𝘂𝗮𝗿𝘆, the first U.S. Bitcoin Exchange-Traded Funds (ETFs) were approved

For the first time, mainstream investors could add Bitcoin to their portfolios through the same platforms they use for stocks and bonds. No wallets, private keys, or exchanges—𝘫𝘶𝘴𝘵 𝘤𝘭𝘪𝘤𝘬 𝘢𝘯𝘥 𝘣𝘶𝘺. 🖱️

Sure, this isn’t the sovereign individual approach to stacking sats, but everyone has to start somewhere, right?

The result has been a tidal wave of institutional demand, and more FOMO from retail buyers. 🌊

But the most important part isn't the price; it's the fall of the next domino on Bitcoin's path to global adoption.

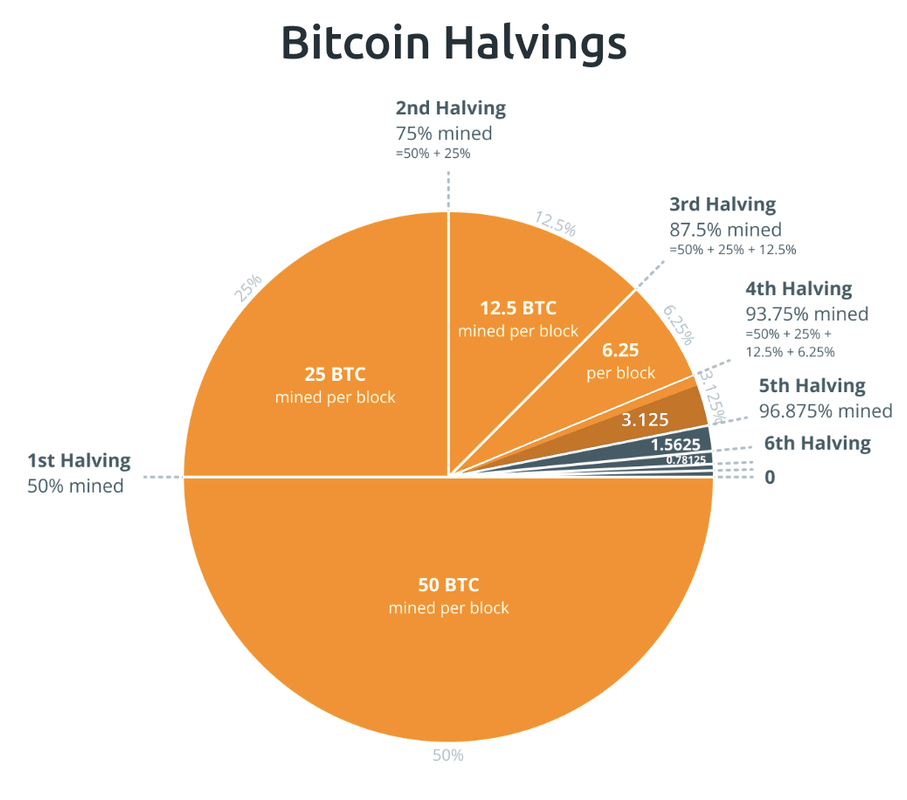

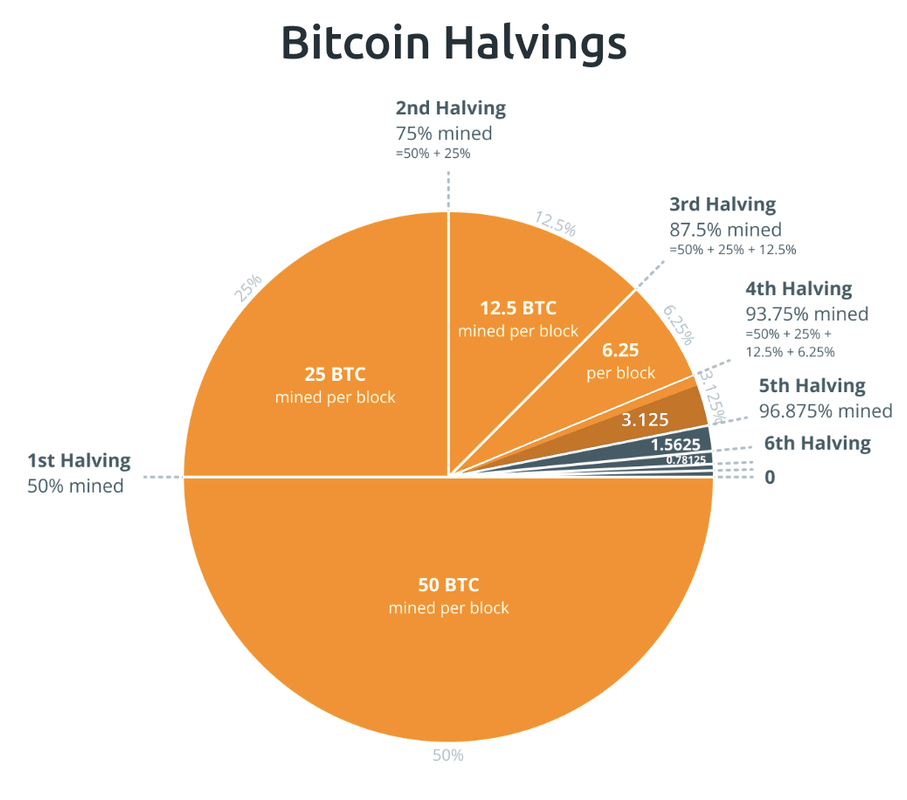

2️⃣ On 𝟭𝟵 𝗔𝗽𝗿𝗶𝗹, Bitcoin's block subsidy halved from 𝟲. 𝟮𝟱 to 𝟯. 𝟭𝟮𝟱

This means that the rate of new bitcoin mined with each block was 𝘤𝘶𝘵 𝘪𝘯 𝘩𝘢𝘭𝘧. So instead of about 900 new bitcoin being mined each day, 𝗼𝗻𝗹𝘆 𝗮𝗯𝗼𝘂𝘁 𝟰𝟱𝟬 𝗮𝗿𝗲 𝗻𝗼𝘄 𝗺𝗶𝗻𝗲𝗱.

Starting at block 840,000, the stock-to-flow ratio—or the ratio of new bitcoin compared to already-existent bitcoin—became roughly twice that of gold, 𝗼𝗳𝗳𝗶𝗰𝗶𝗮𝗹𝗹𝘆 𝗺𝗮𝗸𝗶𝗻𝗴 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝘁𝗵𝗲 𝘀𝗰𝗮𝗿𝗰𝗲𝘀𝘁 𝗺𝗼𝗻𝗲𝘆 𝙚𝙫𝙚𝙧! 🤯

These halvings, which happen every 210,000 blocks—or roughly every 4 years—is how Bitcoin’s supply cap is enforced, and is one of the primary causes of Bitcoin’s 4-year bull/bear cycle.

𝗧𝗵𝗲𝗿𝗲 𝘄𝗶𝗹𝗹 𝗼𝗻𝗹𝘆 𝗲𝘃𝗲𝗿 𝗯𝗲 𝟯𝟯 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗵𝗮𝗹𝘃𝗶𝗻𝗴𝘀, and 4 have already come and gone. Each one marks a turning point in Bitcoin's history, when the world’s hardest money hardens even more, and further secures our civilization against an uncertain future.

2️⃣ On 𝟭𝟵 𝗔𝗽𝗿𝗶𝗹, Bitcoin's block subsidy halved from 𝟲. 𝟮𝟱 to 𝟯. 𝟭𝟮𝟱

This means that the rate of new bitcoin mined with each block was 𝘤𝘶𝘵 𝘪𝘯 𝘩𝘢𝘭𝘧. So instead of about 900 new bitcoin being mined each day, 𝗼𝗻𝗹𝘆 𝗮𝗯𝗼𝘂𝘁 𝟰𝟱𝟬 𝗮𝗿𝗲 𝗻𝗼𝘄 𝗺𝗶𝗻𝗲𝗱.

Starting at block 840,000, the stock-to-flow ratio—or the ratio of new bitcoin compared to already-existent bitcoin—became roughly twice that of gold, 𝗼𝗳𝗳𝗶𝗰𝗶𝗮𝗹𝗹𝘆 𝗺𝗮𝗸𝗶𝗻𝗴 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝘁𝗵𝗲 𝘀𝗰𝗮𝗿𝗰𝗲𝘀𝘁 𝗺𝗼𝗻𝗲𝘆 𝙚𝙫𝙚𝙧! 🤯

These halvings, which happen every 210,000 blocks—or roughly every 4 years—is how Bitcoin’s supply cap is enforced, and is one of the primary causes of Bitcoin’s 4-year bull/bear cycle.

𝗧𝗵𝗲𝗿𝗲 𝘄𝗶𝗹𝗹 𝗼𝗻𝗹𝘆 𝗲𝘃𝗲𝗿 𝗯𝗲 𝟯𝟯 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗵𝗮𝗹𝘃𝗶𝗻𝗴𝘀, and 4 have already come and gone. Each one marks a turning point in Bitcoin's history, when the world’s hardest money hardens even more, and further secures our civilization against an uncertain future.

3️⃣ On 𝟮𝟳 𝗝𝘂𝗹𝘆, Donald Trump gave a keynote speech at @The Bitcoin Conference in Nashville, TN.

This was the first time a former president—who later became President-elect—spoke at a Bitcoin conference...𝘣𝘶𝘵 𝘪𝘵 𝘸𝘰𝘯’𝘵 𝘣𝘦 𝘵𝘩𝘦 𝘭𝘢𝘴𝘵!

Donald Trump declared that he will:

🔓 #FreeRoss from prison on day 1

⚡ Make the U.S. the global hub for Bitcoin mining

👏 Fire Gary Gensler—which, to Trump's surprise, was met with an 𝘦𝘳𝘶𝘱𝘵𝘪𝘰𝘯 of cheers

Donald Trump is still falling down the Bitcoin rabbit hole, so there's still much for him to learn, but the progress he’s making is very promising!

Whether you agree with his politics or not, his support of Bitcoin solidified its role on the national and global stage. 🌎

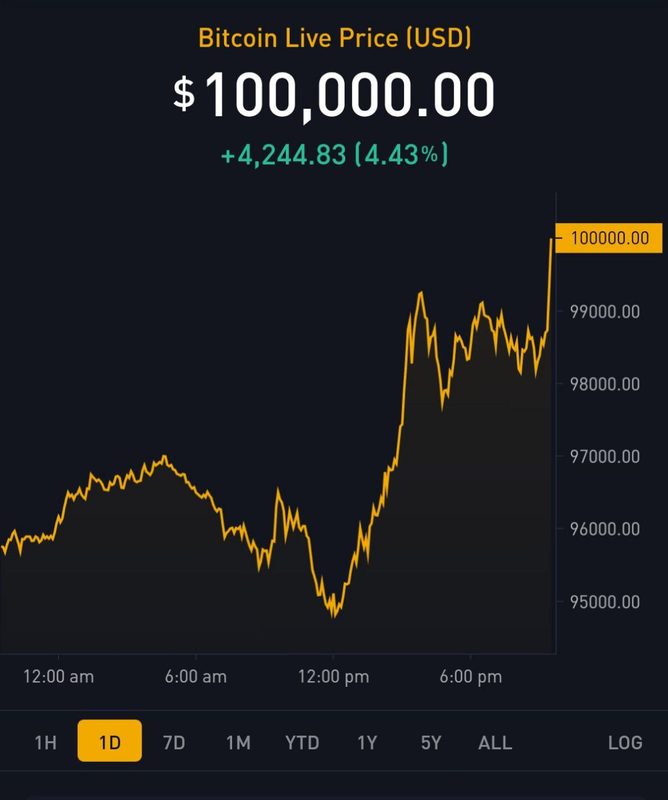

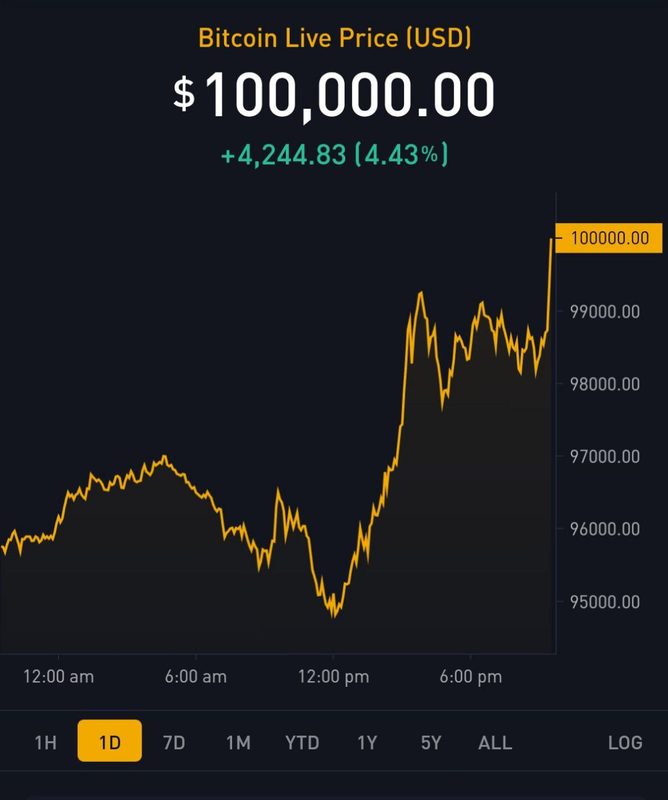

4️⃣ On 𝟱 𝗗𝗲𝗰𝗲𝗺𝗯𝗲𝗿, Bitcoin broke $100K for the first time 🚀

After years of waiting, it finally happened. Many Bitcoiners had vowed to keep “laser ray ‘til 100K” on their social media avatars, but now, with that milestone reached, many adopted a new mantra: 𝘓𝘢𝘴𝘦𝘳 𝘦𝘺𝘦𝘴 ‘𝘵𝘪𝘭 𝘧𝘪𝘢𝘵 𝘥𝘪𝘦𝘴!

𝗪𝗵𝗮𝘁 𝗰𝗮𝘂𝘀𝗲𝗱 𝘁𝗵𝗲 𝘀𝘂𝗱𝗱𝗲𝗻 𝘀𝘂𝗿𝗴𝗲 𝘁𝗼 $𝟭𝟬𝟬𝗞?

Perhaps it was a combination of Donald Trump’s victory a month prior, the ETFs that were more successful than 𝘢𝘯𝘺 other before them, and of course, Bitcoin’s absolutely limited supply.

Or maybe it's just because Bitcoin is an idea whose time has come.

For OG hodlers, 100K was more than a nice round number; it represented vindication after years of FUD and criticism, and it caught the attention of many former naysayers. 👀

The FOMO it’s already causing is an important step toward the next bull run, 𝘸𝘩𝘪𝘤𝘩 𝘪𝘴 𝘫𝘶𝘴𝘵 𝘨𝘦𝘵𝘵𝘪𝘯𝘨 𝘴𝘵𝘢𝘳𝘵𝘦𝘥. 📈

3️⃣ On 𝟮𝟳 𝗝𝘂𝗹𝘆, Donald Trump gave a keynote speech at @The Bitcoin Conference in Nashville, TN.

This was the first time a former president—who later became President-elect—spoke at a Bitcoin conference...𝘣𝘶𝘵 𝘪𝘵 𝘸𝘰𝘯’𝘵 𝘣𝘦 𝘵𝘩𝘦 𝘭𝘢𝘴𝘵!

Donald Trump declared that he will:

🔓 #FreeRoss from prison on day 1

⚡ Make the U.S. the global hub for Bitcoin mining

👏 Fire Gary Gensler—which, to Trump's surprise, was met with an 𝘦𝘳𝘶𝘱𝘵𝘪𝘰𝘯 of cheers

Donald Trump is still falling down the Bitcoin rabbit hole, so there's still much for him to learn, but the progress he’s making is very promising!

Whether you agree with his politics or not, his support of Bitcoin solidified its role on the national and global stage. 🌎

4️⃣ On 𝟱 𝗗𝗲𝗰𝗲𝗺𝗯𝗲𝗿, Bitcoin broke $100K for the first time 🚀

After years of waiting, it finally happened. Many Bitcoiners had vowed to keep “laser ray ‘til 100K” on their social media avatars, but now, with that milestone reached, many adopted a new mantra: 𝘓𝘢𝘴𝘦𝘳 𝘦𝘺𝘦𝘴 ‘𝘵𝘪𝘭 𝘧𝘪𝘢𝘵 𝘥𝘪𝘦𝘴!

𝗪𝗵𝗮𝘁 𝗰𝗮𝘂𝘀𝗲𝗱 𝘁𝗵𝗲 𝘀𝘂𝗱𝗱𝗲𝗻 𝘀𝘂𝗿𝗴𝗲 𝘁𝗼 $𝟭𝟬𝟬𝗞?

Perhaps it was a combination of Donald Trump’s victory a month prior, the ETFs that were more successful than 𝘢𝘯𝘺 other before them, and of course, Bitcoin’s absolutely limited supply.

Or maybe it's just because Bitcoin is an idea whose time has come.

For OG hodlers, 100K was more than a nice round number; it represented vindication after years of FUD and criticism, and it caught the attention of many former naysayers. 👀

The FOMO it’s already causing is an important step toward the next bull run, 𝘸𝘩𝘪𝘤𝘩 𝘪𝘴 𝘫𝘶𝘴𝘵 𝘨𝘦𝘵𝘵𝘪𝘯𝘨 𝘴𝘵𝘢𝘳𝘵𝘦𝘥. 📈

5️⃣ On 𝟭𝟴 𝗗𝗲𝗰𝗲𝗺𝗯𝗲𝗿, El Salvador agreed to the IMF's terms to receive $1.4 billion in aid from them.

The catch? 𝘛𝘩𝘦𝘺 𝘩𝘢𝘥 𝘵𝘰 𝘤𝘩𝘢𝘯𝘨𝘦 𝘵𝘩𝘦𝘪𝘳 𝘭𝘢𝘸 𝘵𝘰 𝘮𝘢𝘬𝘦 𝘣𝘪𝘵𝘤𝘰𝘪𝘯 𝘢𝘤𝘤𝘦𝘱𝘵𝘢𝘯𝘤𝘦 𝘷𝘰𝘭𝘶𝘯𝘵𝘢𝘳𝘺 𝘧𝘰𝘳 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴𝘦𝘴. 😮

It had been compulsory for merchants to accept bitcoin, but this was rarely enforced, so removing it seemed like an acceptable tradeoff for President Bukele.

Since 17 November 2022, El Salvador had been buying 1 bitcoin each day, regardless of the price. But on the 19 December of this year, and again on the 21st, President Bukele used the funds from the IMF to buy 𝟭𝟭 𝗺𝗼𝗿𝗲 bitcoin! 🤯

What would 𝘺𝘰𝘶 do if you suddenly received a large sum of fiat?

Hopefully, you’d buy bitcoin. 😉

5️⃣ On 𝟭𝟴 𝗗𝗲𝗰𝗲𝗺𝗯𝗲𝗿, El Salvador agreed to the IMF's terms to receive $1.4 billion in aid from them.

The catch? 𝘛𝘩𝘦𝘺 𝘩𝘢𝘥 𝘵𝘰 𝘤𝘩𝘢𝘯𝘨𝘦 𝘵𝘩𝘦𝘪𝘳 𝘭𝘢𝘸 𝘵𝘰 𝘮𝘢𝘬𝘦 𝘣𝘪𝘵𝘤𝘰𝘪𝘯 𝘢𝘤𝘤𝘦𝘱𝘵𝘢𝘯𝘤𝘦 𝘷𝘰𝘭𝘶𝘯𝘵𝘢𝘳𝘺 𝘧𝘰𝘳 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴𝘦𝘴. 😮

It had been compulsory for merchants to accept bitcoin, but this was rarely enforced, so removing it seemed like an acceptable tradeoff for President Bukele.

Since 17 November 2022, El Salvador had been buying 1 bitcoin each day, regardless of the price. But on the 19 December of this year, and again on the 21st, President Bukele used the funds from the IMF to buy 𝟭𝟭 𝗺𝗼𝗿𝗲 bitcoin! 🤯

What would 𝘺𝘰𝘶 do if you suddenly received a large sum of fiat?

Hopefully, you’d buy bitcoin. 😉

𝟮𝟬𝟮𝟰 𝘄𝗮𝘀 𝗮𝗻 𝗶𝗻𝗰𝗿𝗲𝗱𝗶𝗯𝗹𝗲 𝘆𝗲𝗮𝗿 𝗳𝗼𝗿 𝗕𝗶𝘁𝗰𝗼𝗶𝗻! 📈

History will doubtlessly record it as the year when nation-states entered the sat-stacking race, and adoption began to change from "𝘨𝘳𝘢𝘥𝘶𝘢𝘭𝘭𝘺" to "𝘴𝘶𝘥𝘥𝘦𝘯𝘭𝘺" (H/T @npub1w69y...zltw ).

Remember to 𝗟𝗶𝗸𝗲, 𝗦𝗵𝗮𝗿𝗲, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸 this note, so you can look back on this next year, and see how far we will have come by then!

What were some of the highlights in the Bitcoin space for you this past year? What are your predictions for 2025? Let us know in the 𝗰𝗼𝗺𝗺𝗲𝗻𝘁𝘀! 👇

𝟮𝟬𝟮𝟰 𝘄𝗮𝘀 𝗮𝗻 𝗶𝗻𝗰𝗿𝗲𝗱𝗶𝗯𝗹𝗲 𝘆𝗲𝗮𝗿 𝗳𝗼𝗿 𝗕𝗶𝘁𝗰𝗼𝗶𝗻! 📈

History will doubtlessly record it as the year when nation-states entered the sat-stacking race, and adoption began to change from "𝘨𝘳𝘢𝘥𝘶𝘢𝘭𝘭𝘺" to "𝘴𝘶𝘥𝘥𝘦𝘯𝘭𝘺" (H/T @npub1w69y...zltw ).

Remember to 𝗟𝗶𝗸𝗲, 𝗦𝗵𝗮𝗿𝗲, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸 this note, so you can look back on this next year, and see how far we will have come by then!

What were some of the highlights in the Bitcoin space for you this past year? What are your predictions for 2025? Let us know in the 𝗰𝗼𝗺𝗺𝗲𝗻𝘁𝘀! 👇

1️⃣ On 𝟭𝟭 𝗝𝗮𝗻𝘂𝗮𝗿𝘆, the first U.S. Bitcoin Exchange-Traded Funds (ETFs) were approved

For the first time, mainstream investors could add Bitcoin to their portfolios through the same platforms they use for stocks and bonds. No wallets, private keys, or exchanges—𝘫𝘶𝘴𝘵 𝘤𝘭𝘪𝘤𝘬 𝘢𝘯𝘥 𝘣𝘶𝘺. 🖱️

Sure, this isn’t the sovereign individual approach to stacking sats, but everyone has to start somewhere, right?

The result has been a tidal wave of institutional demand, and more FOMO from retail buyers. 🌊

But the most important part isn't the price; it's the fall of the next domino on Bitcoin's path to global adoption.

1️⃣ On 𝟭𝟭 𝗝𝗮𝗻𝘂𝗮𝗿𝘆, the first U.S. Bitcoin Exchange-Traded Funds (ETFs) were approved

For the first time, mainstream investors could add Bitcoin to their portfolios through the same platforms they use for stocks and bonds. No wallets, private keys, or exchanges—𝘫𝘶𝘴𝘵 𝘤𝘭𝘪𝘤𝘬 𝘢𝘯𝘥 𝘣𝘶𝘺. 🖱️

Sure, this isn’t the sovereign individual approach to stacking sats, but everyone has to start somewhere, right?

The result has been a tidal wave of institutional demand, and more FOMO from retail buyers. 🌊

But the most important part isn't the price; it's the fall of the next domino on Bitcoin's path to global adoption.

2️⃣ On 𝟭𝟵 𝗔𝗽𝗿𝗶𝗹, Bitcoin's block subsidy halved from 𝟲. 𝟮𝟱 to 𝟯. 𝟭𝟮𝟱

This means that the rate of new bitcoin mined with each block was 𝘤𝘶𝘵 𝘪𝘯 𝘩𝘢𝘭𝘧. So instead of about 900 new bitcoin being mined each day, 𝗼𝗻𝗹𝘆 𝗮𝗯𝗼𝘂𝘁 𝟰𝟱𝟬 𝗮𝗿𝗲 𝗻𝗼𝘄 𝗺𝗶𝗻𝗲𝗱.

Starting at block 840,000, the stock-to-flow ratio—or the ratio of new bitcoin compared to already-existent bitcoin—became roughly twice that of gold, 𝗼𝗳𝗳𝗶𝗰𝗶𝗮𝗹𝗹𝘆 𝗺𝗮𝗸𝗶𝗻𝗴 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝘁𝗵𝗲 𝘀𝗰𝗮𝗿𝗰𝗲𝘀𝘁 𝗺𝗼𝗻𝗲𝘆 𝙚𝙫𝙚𝙧! 🤯

These halvings, which happen every 210,000 blocks—or roughly every 4 years—is how Bitcoin’s supply cap is enforced, and is one of the primary causes of Bitcoin’s 4-year bull/bear cycle.

𝗧𝗵𝗲𝗿𝗲 𝘄𝗶𝗹𝗹 𝗼𝗻𝗹𝘆 𝗲𝘃𝗲𝗿 𝗯𝗲 𝟯𝟯 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗵𝗮𝗹𝘃𝗶𝗻𝗴𝘀, and 4 have already come and gone. Each one marks a turning point in Bitcoin's history, when the world’s hardest money hardens even more, and further secures our civilization against an uncertain future.

2️⃣ On 𝟭𝟵 𝗔𝗽𝗿𝗶𝗹, Bitcoin's block subsidy halved from 𝟲. 𝟮𝟱 to 𝟯. 𝟭𝟮𝟱

This means that the rate of new bitcoin mined with each block was 𝘤𝘶𝘵 𝘪𝘯 𝘩𝘢𝘭𝘧. So instead of about 900 new bitcoin being mined each day, 𝗼𝗻𝗹𝘆 𝗮𝗯𝗼𝘂𝘁 𝟰𝟱𝟬 𝗮𝗿𝗲 𝗻𝗼𝘄 𝗺𝗶𝗻𝗲𝗱.

Starting at block 840,000, the stock-to-flow ratio—or the ratio of new bitcoin compared to already-existent bitcoin—became roughly twice that of gold, 𝗼𝗳𝗳𝗶𝗰𝗶𝗮𝗹𝗹𝘆 𝗺𝗮𝗸𝗶𝗻𝗴 𝗯𝗶𝘁𝗰𝗼𝗶𝗻 𝘁𝗵𝗲 𝘀𝗰𝗮𝗿𝗰𝗲𝘀𝘁 𝗺𝗼𝗻𝗲𝘆 𝙚𝙫𝙚𝙧! 🤯

These halvings, which happen every 210,000 blocks—or roughly every 4 years—is how Bitcoin’s supply cap is enforced, and is one of the primary causes of Bitcoin’s 4-year bull/bear cycle.

𝗧𝗵𝗲𝗿𝗲 𝘄𝗶𝗹𝗹 𝗼𝗻𝗹𝘆 𝗲𝘃𝗲𝗿 𝗯𝗲 𝟯𝟯 𝗕𝗶𝘁𝗰𝗼𝗶𝗻 𝗵𝗮𝗹𝘃𝗶𝗻𝗴𝘀, and 4 have already come and gone. Each one marks a turning point in Bitcoin's history, when the world’s hardest money hardens even more, and further secures our civilization against an uncertain future.

3️⃣ On 𝟮𝟳 𝗝𝘂𝗹𝘆, Donald Trump gave a keynote speech at @The Bitcoin Conference in Nashville, TN.

This was the first time a former president—who later became President-elect—spoke at a Bitcoin conference...𝘣𝘶𝘵 𝘪𝘵 𝘸𝘰𝘯’𝘵 𝘣𝘦 𝘵𝘩𝘦 𝘭𝘢𝘴𝘵!

Donald Trump declared that he will:

🔓 #FreeRoss from prison on day 1

⚡ Make the U.S. the global hub for Bitcoin mining

👏 Fire Gary Gensler—which, to Trump's surprise, was met with an 𝘦𝘳𝘶𝘱𝘵𝘪𝘰𝘯 of cheers

Donald Trump is still falling down the Bitcoin rabbit hole, so there's still much for him to learn, but the progress he’s making is very promising!

Whether you agree with his politics or not, his support of Bitcoin solidified its role on the national and global stage. 🌎

4️⃣ On 𝟱 𝗗𝗲𝗰𝗲𝗺𝗯𝗲𝗿, Bitcoin broke $100K for the first time 🚀

After years of waiting, it finally happened. Many Bitcoiners had vowed to keep “laser ray ‘til 100K” on their social media avatars, but now, with that milestone reached, many adopted a new mantra: 𝘓𝘢𝘴𝘦𝘳 𝘦𝘺𝘦𝘴 ‘𝘵𝘪𝘭 𝘧𝘪𝘢𝘵 𝘥𝘪𝘦𝘴!

𝗪𝗵𝗮𝘁 𝗰𝗮𝘂𝘀𝗲𝗱 𝘁𝗵𝗲 𝘀𝘂𝗱𝗱𝗲𝗻 𝘀𝘂𝗿𝗴𝗲 𝘁𝗼 $𝟭𝟬𝟬𝗞?

Perhaps it was a combination of Donald Trump’s victory a month prior, the ETFs that were more successful than 𝘢𝘯𝘺 other before them, and of course, Bitcoin’s absolutely limited supply.

Or maybe it's just because Bitcoin is an idea whose time has come.

For OG hodlers, 100K was more than a nice round number; it represented vindication after years of FUD and criticism, and it caught the attention of many former naysayers. 👀

The FOMO it’s already causing is an important step toward the next bull run, 𝘸𝘩𝘪𝘤𝘩 𝘪𝘴 𝘫𝘶𝘴𝘵 𝘨𝘦𝘵𝘵𝘪𝘯𝘨 𝘴𝘵𝘢𝘳𝘵𝘦𝘥. 📈

3️⃣ On 𝟮𝟳 𝗝𝘂𝗹𝘆, Donald Trump gave a keynote speech at @The Bitcoin Conference in Nashville, TN.

This was the first time a former president—who later became President-elect—spoke at a Bitcoin conference...𝘣𝘶𝘵 𝘪𝘵 𝘸𝘰𝘯’𝘵 𝘣𝘦 𝘵𝘩𝘦 𝘭𝘢𝘴𝘵!

Donald Trump declared that he will:

🔓 #FreeRoss from prison on day 1

⚡ Make the U.S. the global hub for Bitcoin mining

👏 Fire Gary Gensler—which, to Trump's surprise, was met with an 𝘦𝘳𝘶𝘱𝘵𝘪𝘰𝘯 of cheers

Donald Trump is still falling down the Bitcoin rabbit hole, so there's still much for him to learn, but the progress he’s making is very promising!

Whether you agree with his politics or not, his support of Bitcoin solidified its role on the national and global stage. 🌎

4️⃣ On 𝟱 𝗗𝗲𝗰𝗲𝗺𝗯𝗲𝗿, Bitcoin broke $100K for the first time 🚀

After years of waiting, it finally happened. Many Bitcoiners had vowed to keep “laser ray ‘til 100K” on their social media avatars, but now, with that milestone reached, many adopted a new mantra: 𝘓𝘢𝘴𝘦𝘳 𝘦𝘺𝘦𝘴 ‘𝘵𝘪𝘭 𝘧𝘪𝘢𝘵 𝘥𝘪𝘦𝘴!

𝗪𝗵𝗮𝘁 𝗰𝗮𝘂𝘀𝗲𝗱 𝘁𝗵𝗲 𝘀𝘂𝗱𝗱𝗲𝗻 𝘀𝘂𝗿𝗴𝗲 𝘁𝗼 $𝟭𝟬𝟬𝗞?

Perhaps it was a combination of Donald Trump’s victory a month prior, the ETFs that were more successful than 𝘢𝘯𝘺 other before them, and of course, Bitcoin’s absolutely limited supply.

Or maybe it's just because Bitcoin is an idea whose time has come.

For OG hodlers, 100K was more than a nice round number; it represented vindication after years of FUD and criticism, and it caught the attention of many former naysayers. 👀

The FOMO it’s already causing is an important step toward the next bull run, 𝘸𝘩𝘪𝘤𝘩 𝘪𝘴 𝘫𝘶𝘴𝘵 𝘨𝘦𝘵𝘵𝘪𝘯𝘨 𝘴𝘵𝘢𝘳𝘵𝘦𝘥. 📈

5️⃣ On 𝟭𝟴 𝗗𝗲𝗰𝗲𝗺𝗯𝗲𝗿, El Salvador agreed to the IMF's terms to receive $1.4 billion in aid from them.

The catch? 𝘛𝘩𝘦𝘺 𝘩𝘢𝘥 𝘵𝘰 𝘤𝘩𝘢𝘯𝘨𝘦 𝘵𝘩𝘦𝘪𝘳 𝘭𝘢𝘸 𝘵𝘰 𝘮𝘢𝘬𝘦 𝘣𝘪𝘵𝘤𝘰𝘪𝘯 𝘢𝘤𝘤𝘦𝘱𝘵𝘢𝘯𝘤𝘦 𝘷𝘰𝘭𝘶𝘯𝘵𝘢𝘳𝘺 𝘧𝘰𝘳 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴𝘦𝘴. 😮

It had been compulsory for merchants to accept bitcoin, but this was rarely enforced, so removing it seemed like an acceptable tradeoff for President Bukele.

Since 17 November 2022, El Salvador had been buying 1 bitcoin each day, regardless of the price. But on the 19 December of this year, and again on the 21st, President Bukele used the funds from the IMF to buy 𝟭𝟭 𝗺𝗼𝗿𝗲 bitcoin! 🤯

What would 𝘺𝘰𝘶 do if you suddenly received a large sum of fiat?

Hopefully, you’d buy bitcoin. 😉

5️⃣ On 𝟭𝟴 𝗗𝗲𝗰𝗲𝗺𝗯𝗲𝗿, El Salvador agreed to the IMF's terms to receive $1.4 billion in aid from them.

The catch? 𝘛𝘩𝘦𝘺 𝘩𝘢𝘥 𝘵𝘰 𝘤𝘩𝘢𝘯𝘨𝘦 𝘵𝘩𝘦𝘪𝘳 𝘭𝘢𝘸 𝘵𝘰 𝘮𝘢𝘬𝘦 𝘣𝘪𝘵𝘤𝘰𝘪𝘯 𝘢𝘤𝘤𝘦𝘱𝘵𝘢𝘯𝘤𝘦 𝘷𝘰𝘭𝘶𝘯𝘵𝘢𝘳𝘺 𝘧𝘰𝘳 𝘣𝘶𝘴𝘪𝘯𝘦𝘴𝘴𝘦𝘴. 😮

It had been compulsory for merchants to accept bitcoin, but this was rarely enforced, so removing it seemed like an acceptable tradeoff for President Bukele.

Since 17 November 2022, El Salvador had been buying 1 bitcoin each day, regardless of the price. But on the 19 December of this year, and again on the 21st, President Bukele used the funds from the IMF to buy 𝟭𝟭 𝗺𝗼𝗿𝗲 bitcoin! 🤯

What would 𝘺𝘰𝘶 do if you suddenly received a large sum of fiat?

Hopefully, you’d buy bitcoin. 😉

𝟮𝟬𝟮𝟰 𝘄𝗮𝘀 𝗮𝗻 𝗶𝗻𝗰𝗿𝗲𝗱𝗶𝗯𝗹𝗲 𝘆𝗲𝗮𝗿 𝗳𝗼𝗿 𝗕𝗶𝘁𝗰𝗼𝗶𝗻! 📈

History will doubtlessly record it as the year when nation-states entered the sat-stacking race, and adoption began to change from "𝘨𝘳𝘢𝘥𝘶𝘢𝘭𝘭𝘺" to "𝘴𝘶𝘥𝘥𝘦𝘯𝘭𝘺" (H/T @npub1w69y...zltw ).

Remember to 𝗟𝗶𝗸𝗲, 𝗦𝗵𝗮𝗿𝗲, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸 this note, so you can look back on this next year, and see how far we will have come by then!

What were some of the highlights in the Bitcoin space for you this past year? What are your predictions for 2025? Let us know in the 𝗰𝗼𝗺𝗺𝗲𝗻𝘁𝘀! 👇

𝟮𝟬𝟮𝟰 𝘄𝗮𝘀 𝗮𝗻 𝗶𝗻𝗰𝗿𝗲𝗱𝗶𝗯𝗹𝗲 𝘆𝗲𝗮𝗿 𝗳𝗼𝗿 𝗕𝗶𝘁𝗰𝗼𝗶𝗻! 📈

History will doubtlessly record it as the year when nation-states entered the sat-stacking race, and adoption began to change from "𝘨𝘳𝘢𝘥𝘶𝘢𝘭𝘭𝘺" to "𝘴𝘶𝘥𝘥𝘦𝘯𝘭𝘺" (H/T @npub1w69y...zltw ).

Remember to 𝗟𝗶𝗸𝗲, 𝗦𝗵𝗮𝗿𝗲, and 𝗕𝗼𝗼𝗸𝗺𝗮𝗿𝗸 this note, so you can look back on this next year, and see how far we will have come by then!

What were some of the highlights in the Bitcoin space for you this past year? What are your predictions for 2025? Let us know in the 𝗰𝗼𝗺𝗺𝗲𝗻𝘁𝘀! 👇

1️⃣ 𝗙𝗿𝗲𝗲𝗱𝗼𝗺 𝗼𝗳 𝗠𝗼𝘃𝗲𝗺𝗲𝗻𝘁

Flag Theory is about 𝗱𝗶𝘃𝗲𝗿𝘀𝗶𝗳𝘆𝗶𝗻𝗴 𝘆𝗼𝘂𝗿 𝗹𝗶𝗳𝗲 𝗮𝗰𝗿𝗼𝘀𝘀 𝗯𝗼𝗿𝗱𝗲𝗿𝘀. By planting “flags” in different countries—like citizenship, residency, or asset locations—you reduce your dependence on any single government and gain true freedom.

It starts with your 𝘮𝘰𝘣𝘪𝘭𝘪𝘵𝘺. One passport is a leash, tying you to one nation’s rules, crises, and limitations.

Planting a citizenship flag in another country changes everything:

🌍 Visa-free travel to dozens (or hundreds) more destinations.

🏡 Residency in stable, opportunity-rich regions.

🚪 A personal escape route if your home country becomes unsafe.

Bitcoiners and freedom-seekers alike understand this: 𝘮𝘰𝘣𝘪𝘭𝘪𝘵𝘺 𝘪𝘴 𝘧𝘰𝘶𝘯𝘥𝘢𝘵𝘪𝘰𝘯𝘢𝘭 𝘵𝘰 𝘴𝘰𝘷𝘦𝘳𝘦𝘪𝘨𝘯𝘵𝘺. With multiple passports, you’ll never be stuck in the wrong place at the wrong time. 🛂

1️⃣ 𝗙𝗿𝗲𝗲𝗱𝗼𝗺 𝗼𝗳 𝗠𝗼𝘃𝗲𝗺𝗲𝗻𝘁

Flag Theory is about 𝗱𝗶𝘃𝗲𝗿𝘀𝗶𝗳𝘆𝗶𝗻𝗴 𝘆𝗼𝘂𝗿 𝗹𝗶𝗳𝗲 𝗮𝗰𝗿𝗼𝘀𝘀 𝗯𝗼𝗿𝗱𝗲𝗿𝘀. By planting “flags” in different countries—like citizenship, residency, or asset locations—you reduce your dependence on any single government and gain true freedom.

It starts with your 𝘮𝘰𝘣𝘪𝘭𝘪𝘵𝘺. One passport is a leash, tying you to one nation’s rules, crises, and limitations.

Planting a citizenship flag in another country changes everything:

🌍 Visa-free travel to dozens (or hundreds) more destinations.

🏡 Residency in stable, opportunity-rich regions.

🚪 A personal escape route if your home country becomes unsafe.

Bitcoiners and freedom-seekers alike understand this: 𝘮𝘰𝘣𝘪𝘭𝘪𝘵𝘺 𝘪𝘴 𝘧𝘰𝘶𝘯𝘥𝘢𝘵𝘪𝘰𝘯𝘢𝘭 𝘵𝘰 𝘴𝘰𝘷𝘦𝘳𝘦𝘪𝘨𝘯𝘵𝘺. With multiple passports, you’ll never be stuck in the wrong place at the wrong time. 🛂

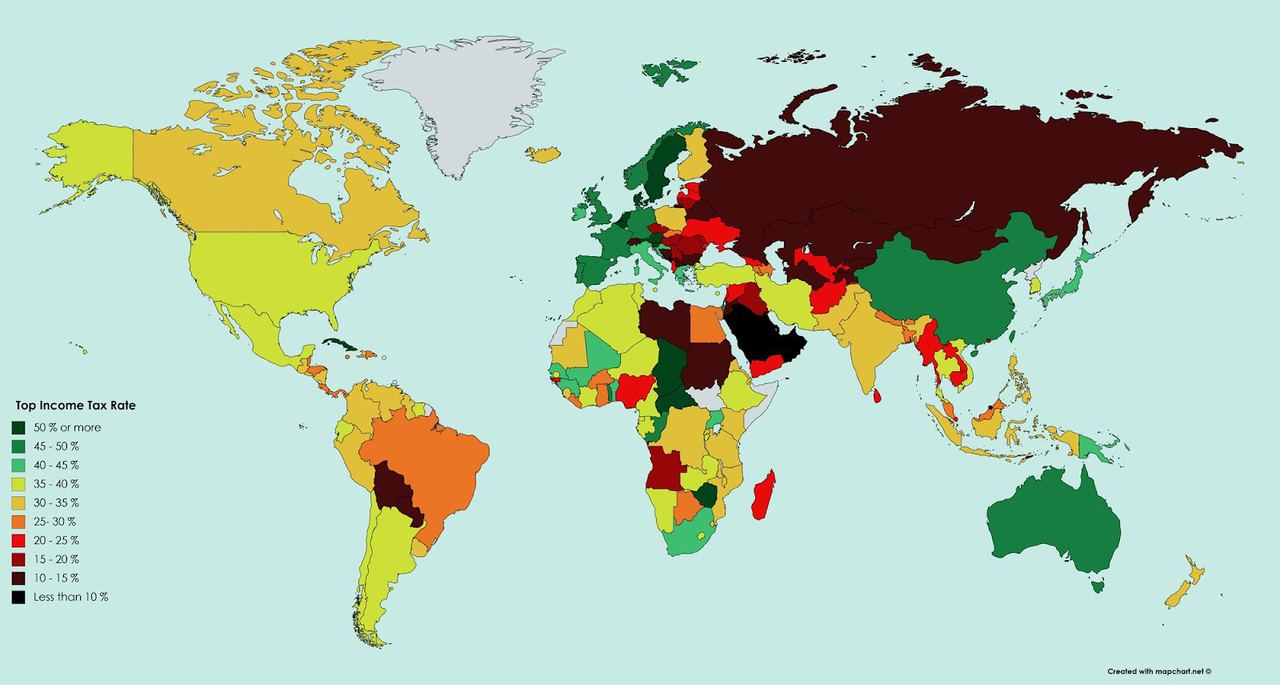

2️⃣ 𝗧𝗮𝘅 𝗢𝗽𝘁𝗶𝗺𝗶𝘇𝗮𝘁𝗶𝗼𝗻

Your tax burden often depends on where you live, not where you earn. This means that a simple change in residency could significantly reduce or even eliminate your taxes.

Flag Theory helps you legally reduce taxes by moving to jurisdictions with low or no income taxes. Bitcoiners can protect their sats by relocating to countries like the UAE, Monaco, or El Salvador, 𝘄𝗵𝗲𝗿𝗲 𝘁𝗵𝗲 𝘁𝗮𝘅 𝗯𝘂𝗿𝗱𝗲𝗻 𝗶𝘀 𝗮𝗹𝗺𝗼𝘀𝘁 𝗻𝗼𝗻𝗲𝘅𝗶𝘀𝘁𝗲𝗻𝘁.

This isn’t tax evasion—it’s 𝘴𝘵𝘳𝘢𝘵𝘦𝘨𝘺. By opting out of high-tax systems, you reinvest in your hodlings and your future. 💼

2️⃣ 𝗧𝗮𝘅 𝗢𝗽𝘁𝗶𝗺𝗶𝘇𝗮𝘁𝗶𝗼𝗻

Your tax burden often depends on where you live, not where you earn. This means that a simple change in residency could significantly reduce or even eliminate your taxes.

Flag Theory helps you legally reduce taxes by moving to jurisdictions with low or no income taxes. Bitcoiners can protect their sats by relocating to countries like the UAE, Monaco, or El Salvador, 𝘄𝗵𝗲𝗿𝗲 𝘁𝗵𝗲 𝘁𝗮𝘅 𝗯𝘂𝗿𝗱𝗲𝗻 𝗶𝘀 𝗮𝗹𝗺𝗼𝘀𝘁 𝗻𝗼𝗻𝗲𝘅𝗶𝘀𝘁𝗲𝗻𝘁.

This isn’t tax evasion—it’s 𝘴𝘵𝘳𝘢𝘵𝘦𝘨𝘺. By opting out of high-tax systems, you reinvest in your hodlings and your future. 💼

3️⃣ 𝗔𝘀𝘀𝗲𝘁 𝗣𝗿𝗼𝘁𝗲𝗰𝘁𝗶𝗼𝗻

“𝘋𝘰𝘯’𝘵 𝘱𝘶𝘵 𝘢𝘭𝘭 𝘺𝘰𝘶𝘳 𝘦𝘨𝘨𝘴 𝘪𝘯 𝘰𝘯𝘦 𝘣𝘢𝘴𝘬𝘦𝘵” isn’t just advice for investing—it’s essential for asset security.

Flag Theory enables you to plant asset flags to safeguard your wealth from lawsuits, inflation, and political overreach.

💸 Offshore bank accounts in stable currencies protect against local instability.

🪙 Bitcoin—the ultimate hard asset—hedges against inflation and debasement.

🏦 Foreign trusts or companies provide legal barriers to shield your sats and investments.

Bitcoiners already understand the power of decentralized money. With Flag Theory, you can complement that with decentralized asset storage. That way, 𝘯𝘰 𝘴𝘪𝘯𝘨𝘭𝘦 𝘨𝘰𝘷𝘦𝘳𝘯𝘮𝘦𝘯𝘵, 𝘦𝘤𝘰𝘯𝘰𝘮𝘺, 𝘰𝘳 𝘤𝘳𝘪𝘴𝘪𝘴 𝘤𝘢𝘯 𝘥𝘦𝘴𝘵𝘳𝘰𝘺 𝘺𝘰𝘶𝘳 𝘸𝘦𝘢𝘭𝘵𝘩.

3️⃣ 𝗔𝘀𝘀𝗲𝘁 𝗣𝗿𝗼𝘁𝗲𝗰𝘁𝗶𝗼𝗻

“𝘋𝘰𝘯’𝘵 𝘱𝘶𝘵 𝘢𝘭𝘭 𝘺𝘰𝘶𝘳 𝘦𝘨𝘨𝘴 𝘪𝘯 𝘰𝘯𝘦 𝘣𝘢𝘴𝘬𝘦𝘵” isn’t just advice for investing—it’s essential for asset security.

Flag Theory enables you to plant asset flags to safeguard your wealth from lawsuits, inflation, and political overreach.

💸 Offshore bank accounts in stable currencies protect against local instability.

🪙 Bitcoin—the ultimate hard asset—hedges against inflation and debasement.

🏦 Foreign trusts or companies provide legal barriers to shield your sats and investments.

Bitcoiners already understand the power of decentralized money. With Flag Theory, you can complement that with decentralized asset storage. That way, 𝘯𝘰 𝘴𝘪𝘯𝘨𝘭𝘦 𝘨𝘰𝘷𝘦𝘳𝘯𝘮𝘦𝘯𝘵, 𝘦𝘤𝘰𝘯𝘰𝘮𝘺, 𝘰𝘳 𝘤𝘳𝘪𝘴𝘪𝘴 𝘤𝘢𝘯 𝘥𝘦𝘴𝘵𝘳𝘰𝘺 𝘺𝘰𝘶𝘳 𝘸𝘦𝘢𝘭𝘵𝘩.

4️⃣ 𝗔𝗰𝗰𝗲𝘀𝘀 𝘁𝗼 𝗚𝗹𝗼𝗯𝗮𝗹 𝗢𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝗶𝗲𝘀

Every country offers unique advantages—𝘣𝘶𝘵 𝘺𝘰𝘶 𝘯𝘦𝘦𝘥 𝘵𝘩𝘦 𝘣𝘦𝘴𝘵 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘪𝘯𝘨 𝘵𝘰 𝘢𝘤𝘤𝘦𝘴𝘴 𝘵𝘩𝘦𝘮.

Flag Theory empowers you to plant business and lifestyle flags wherever opportunities are richest.

🏢 Incorporate a company in Bitcoin-friendly jurisdictions like Wyoming, Singapore, or El Salvador to benefit from bitcoin-friendly regulations.

💵 Open international bank accounts that seamlessly integrate with your bitcoin holdings.

🏫 Relocate to countries with excellent education and healthcare systems for your family’s future.

By spanning the globe, Bitcoiners can amplify their financial freedom with a life tailored to global opportunities. 🌎

4️⃣ 𝗔𝗰𝗰𝗲𝘀𝘀 𝘁𝗼 𝗚𝗹𝗼𝗯𝗮𝗹 𝗢𝗽𝗽𝗼𝗿𝘁𝘂𝗻𝗶𝘁𝗶𝗲𝘀

Every country offers unique advantages—𝘣𝘶𝘵 𝘺𝘰𝘶 𝘯𝘦𝘦𝘥 𝘵𝘩𝘦 𝘣𝘦𝘴𝘵 𝘱𝘰𝘴𝘪𝘵𝘪𝘰𝘯𝘪𝘯𝘨 𝘵𝘰 𝘢𝘤𝘤𝘦𝘴𝘴 𝘵𝘩𝘦𝘮.

Flag Theory empowers you to plant business and lifestyle flags wherever opportunities are richest.

🏢 Incorporate a company in Bitcoin-friendly jurisdictions like Wyoming, Singapore, or El Salvador to benefit from bitcoin-friendly regulations.

💵 Open international bank accounts that seamlessly integrate with your bitcoin holdings.

🏫 Relocate to countries with excellent education and healthcare systems for your family’s future.

By spanning the globe, Bitcoiners can amplify their financial freedom with a life tailored to global opportunities. 🌎

5️⃣ 𝗥𝗲𝘀𝗶𝗹𝗶𝗲𝗻𝗰𝗲 𝗶𝗻 𝗨𝗻𝗰𝗲𝗿𝘁𝗮𝗶𝗻 𝗧𝗶𝗺𝗲𝘀

The world is unpredictable. Economic collapses, political unrest, and even pandemics can disrupt lives overnight. 𝘍𝘭𝘢𝘨 𝘛𝘩𝘦𝘰𝘳𝘺 𝘦𝘯𝘴𝘶𝘳𝘦𝘴 𝘺𝘰𝘶’𝘳𝘦 𝘳𝘦𝘢𝘥𝘺 𝘧𝘰𝘳 𝘢𝘯𝘺𝘵𝘩𝘪𝘯𝘨.

For Bitcoiners, the lesson is clear: 𝗱𝗼𝗻’𝘁 𝘁𝗿𝘂𝘀𝘁; 𝘃𝗲𝗿𝗶𝗳𝘆. With multiple passports and decentralized wealth like Bitcoin, you’re never dependent on trusting a single country or institution—or any fiat currency—with your stored value.

This is more than just a backup plan. It’s about thriving on your terms, with flexibility and freedom at its core. 💡

5️⃣ 𝗥𝗲𝘀𝗶𝗹𝗶𝗲𝗻𝗰𝗲 𝗶𝗻 𝗨𝗻𝗰𝗲𝗿𝘁𝗮𝗶𝗻 𝗧𝗶𝗺𝗲𝘀

The world is unpredictable. Economic collapses, political unrest, and even pandemics can disrupt lives overnight. 𝘍𝘭𝘢𝘨 𝘛𝘩𝘦𝘰𝘳𝘺 𝘦𝘯𝘴𝘶𝘳𝘦𝘴 𝘺𝘰𝘶’𝘳𝘦 𝘳𝘦𝘢𝘥𝘺 𝘧𝘰𝘳 𝘢𝘯𝘺𝘵𝘩𝘪𝘯𝘨.

For Bitcoiners, the lesson is clear: 𝗱𝗼𝗻’𝘁 𝘁𝗿𝘂𝘀𝘁; 𝘃𝗲𝗿𝗶𝗳𝘆. With multiple passports and decentralized wealth like Bitcoin, you’re never dependent on trusting a single country or institution—or any fiat currency—with your stored value.

This is more than just a backup plan. It’s about thriving on your terms, with flexibility and freedom at its core. 💡

𝗧𝗵𝗲 𝘄𝗼𝗿𝗹𝗱 𝗶𝘀 𝗰𝗵𝗮𝗻𝗴𝗶𝗻𝗴, 𝙛𝙖𝙨𝙩.

Flag Theory isn’t just a strategy—it’s a 𝘮𝘪𝘯𝘥𝘴𝘦𝘵. It’s for anyone who values freedom, security, and opportunity in an unpredictable world.

You don’t need to be rich to get started—𝘆𝗼𝘂 𝗷𝘂𝘀𝘁 𝗻𝗲𝗲𝗱 𝘁𝗼 𝘁𝗵𝗶𝗻𝗸 𝗴𝗹𝗼𝗯𝗮𝗹𝗹𝘆, 𝗮𝗻𝗱 𝘀𝘁𝗮𝗿𝘁 𝘀𝘁𝗮𝗰𝗸𝗶𝗻𝗴 𝘀𝗮𝘁𝘀. 🌍

Your first flag could be any of these below. But what will your 𝘴𝘦𝘤𝘰𝘯𝘥 flag be?

𝗧𝗵𝗲 𝘄𝗼𝗿𝗹𝗱 𝗶𝘀 𝗰𝗵𝗮𝗻𝗴𝗶𝗻𝗴, 𝙛𝙖𝙨𝙩.

Flag Theory isn’t just a strategy—it’s a 𝘮𝘪𝘯𝘥𝘴𝘦𝘵. It’s for anyone who values freedom, security, and opportunity in an unpredictable world.

You don’t need to be rich to get started—𝘆𝗼𝘂 𝗷𝘂𝘀𝘁 𝗻𝗲𝗲𝗱 𝘁𝗼 𝘁𝗵𝗶𝗻𝗸 𝗴𝗹𝗼𝗯𝗮𝗹𝗹𝘆, 𝗮𝗻𝗱 𝘀𝘁𝗮𝗿𝘁 𝘀𝘁𝗮𝗰𝗸𝗶𝗻𝗴 𝘀𝗮𝘁𝘀. 🌍

Your first flag could be any of these below. But what will your 𝘴𝘦𝘤𝘰𝘯𝘥 flag be?