In the digital age there will not be 100’s or 1000’s of different monies.

There will be only ONE.

At present, all logic is pointing to bitcoin.

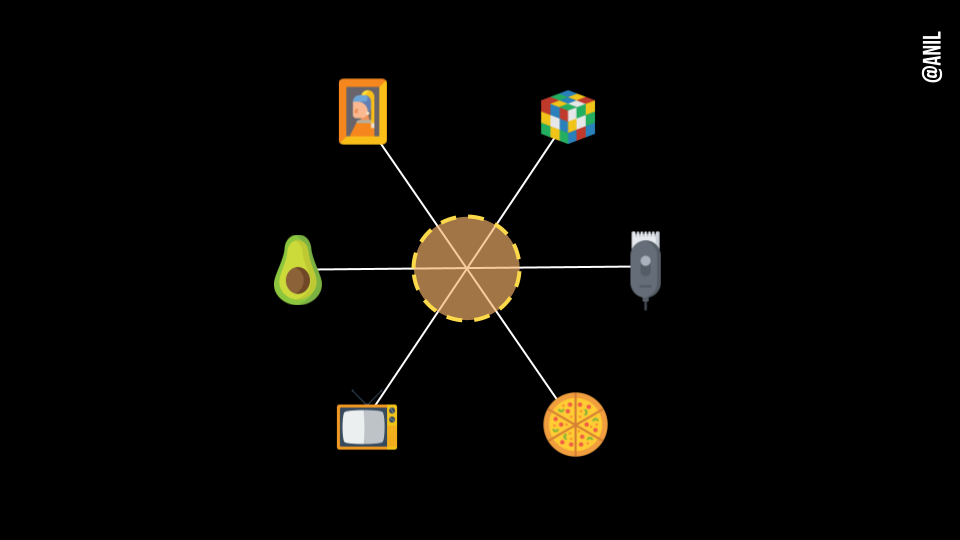

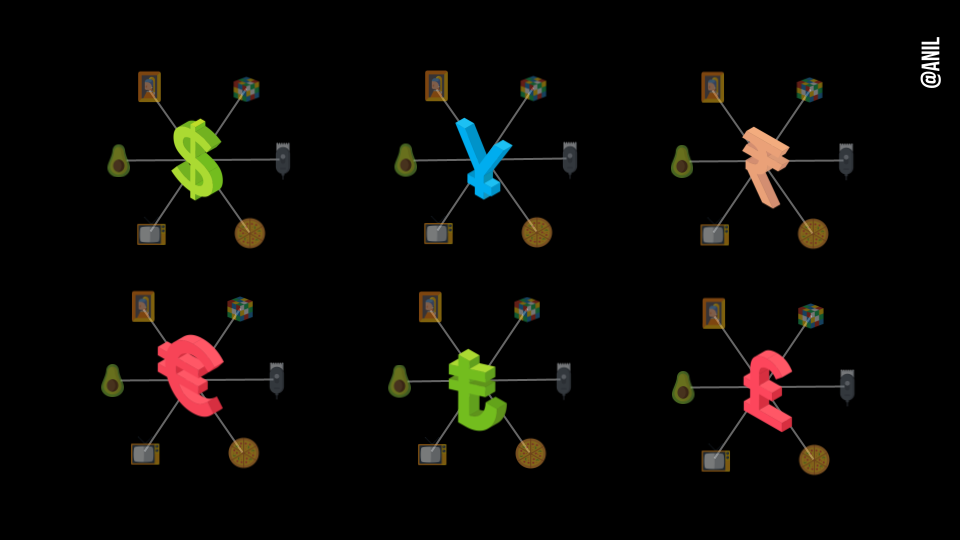

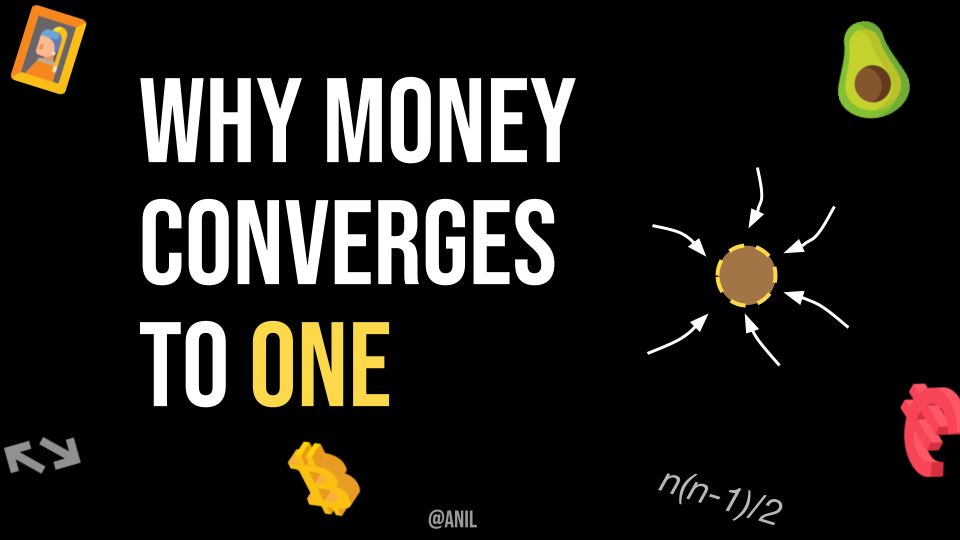

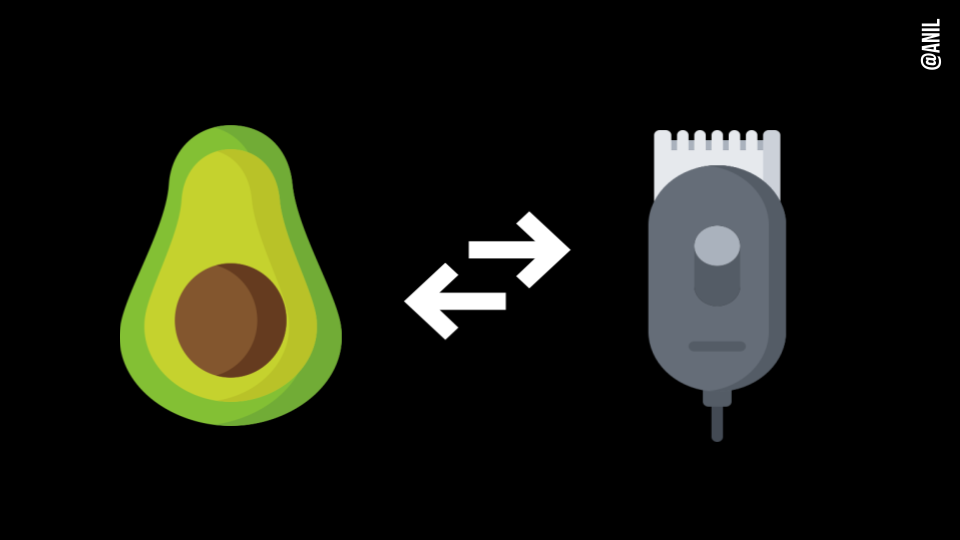

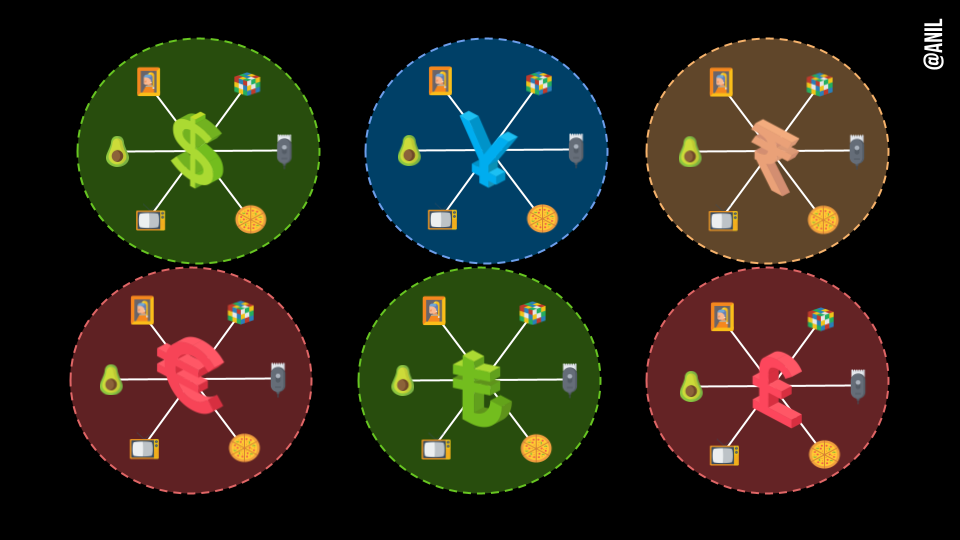

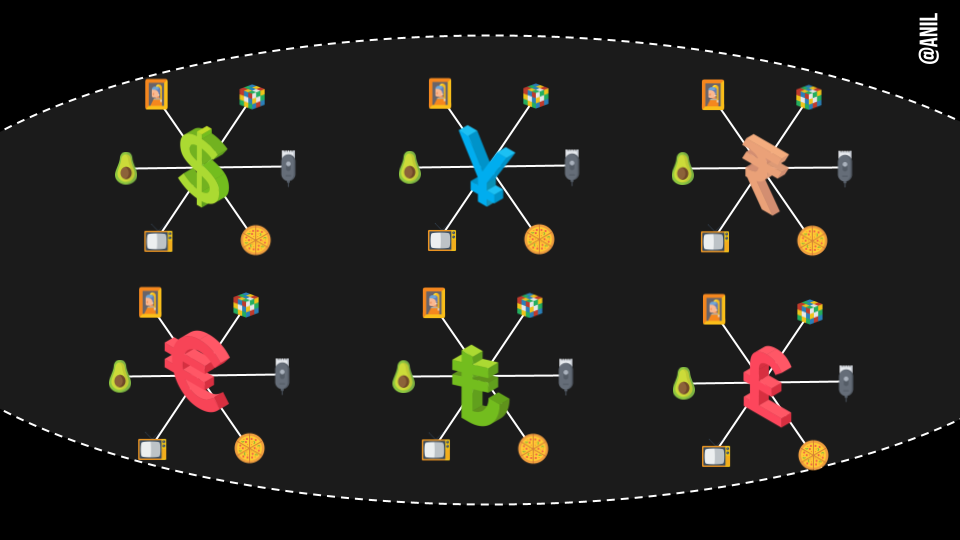

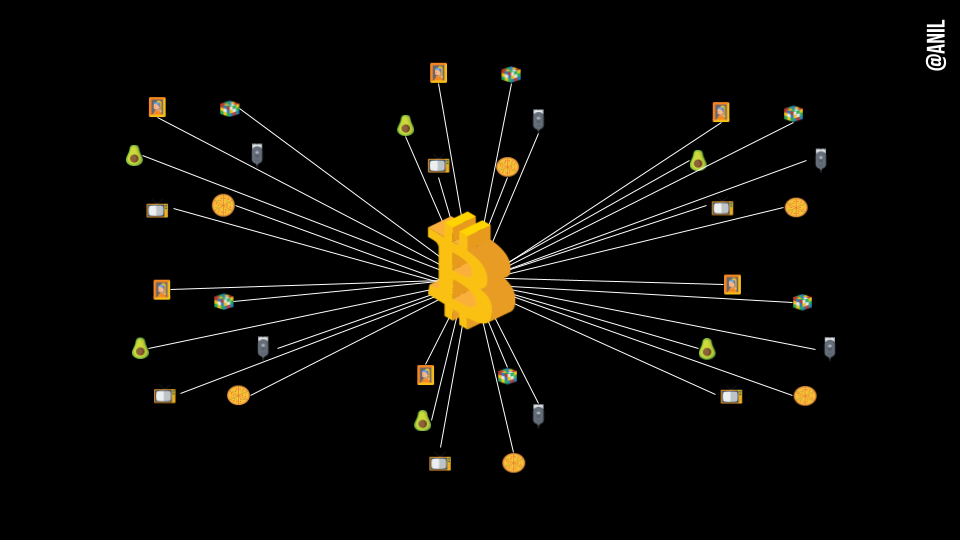

Let’s start with exchanging one good or service for another is a process known as barter exchange.

Barter can work at small scales.

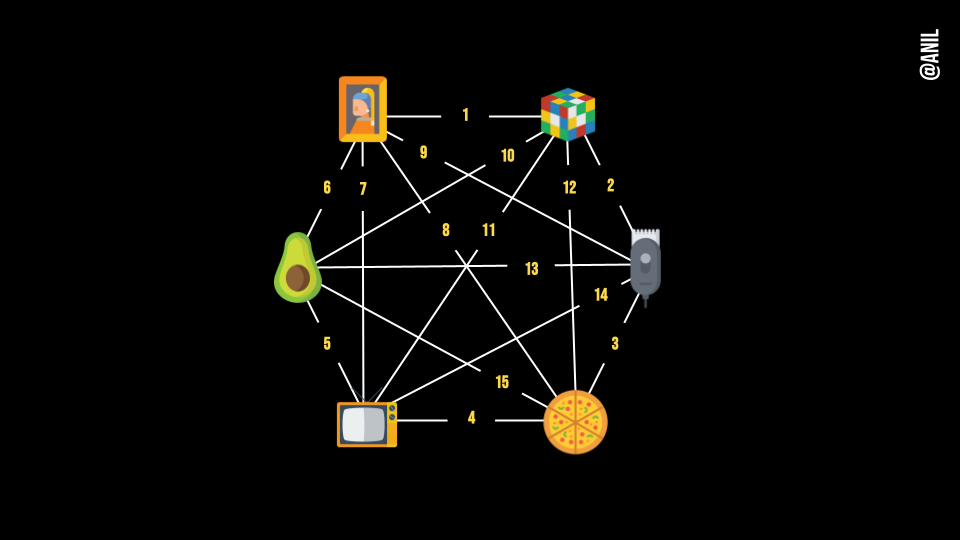

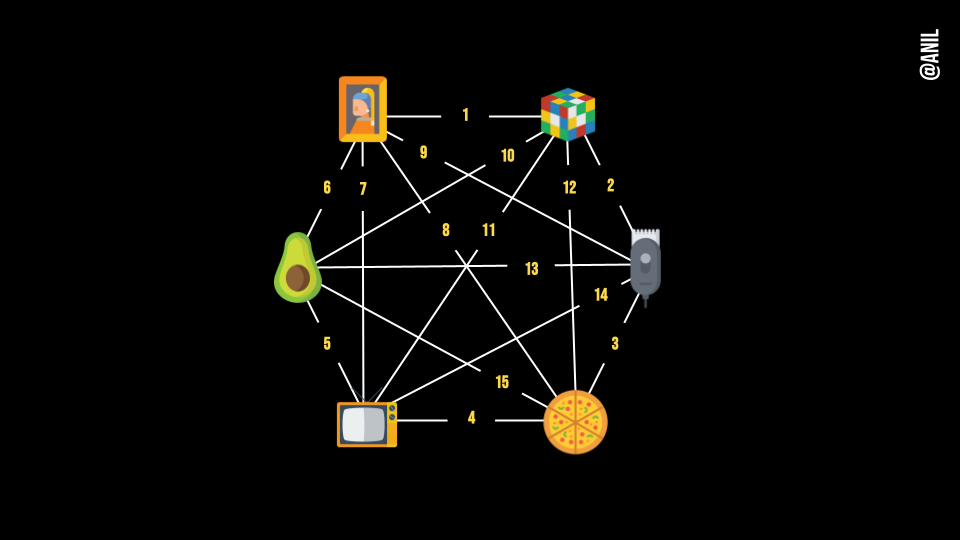

Here’s an example with 6 unique items.

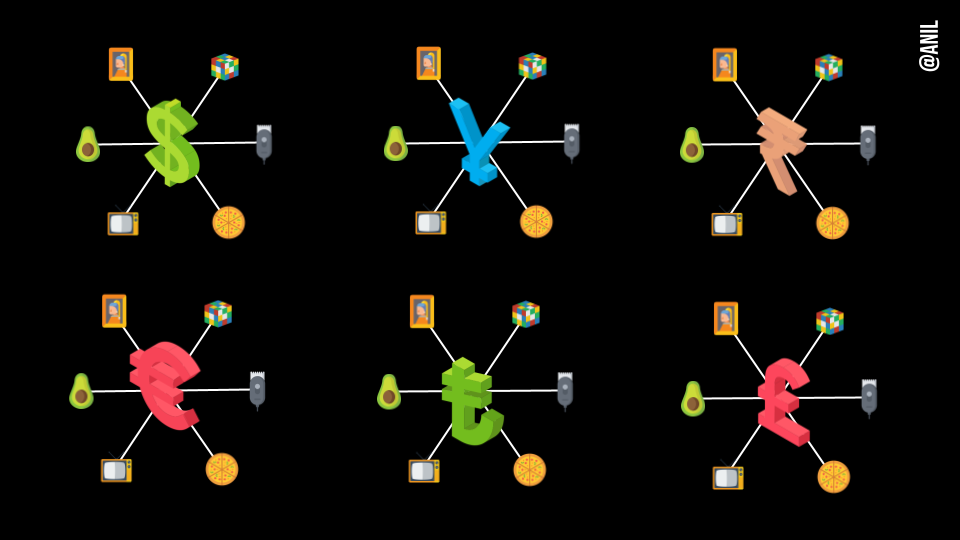

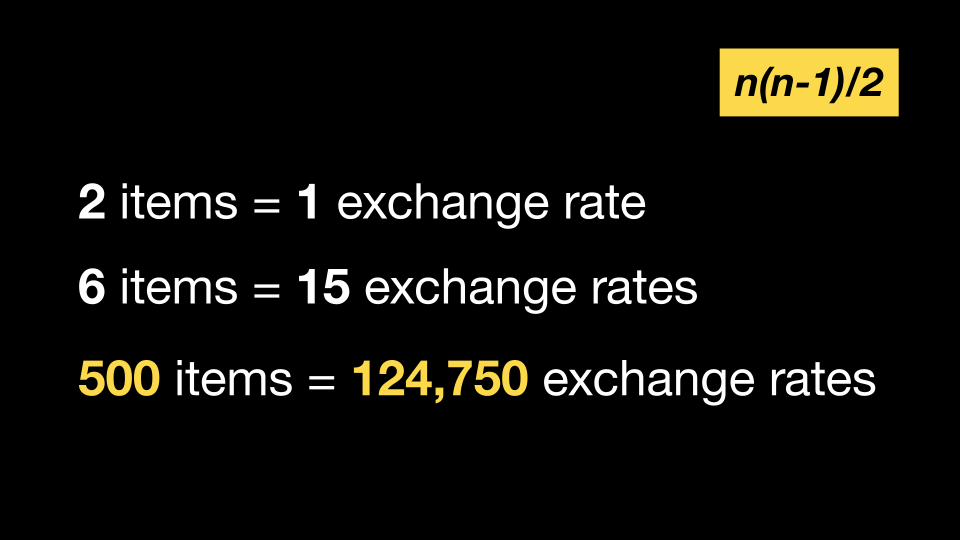

This economy of 6 items requires keeping track of 15 different exchange rates.

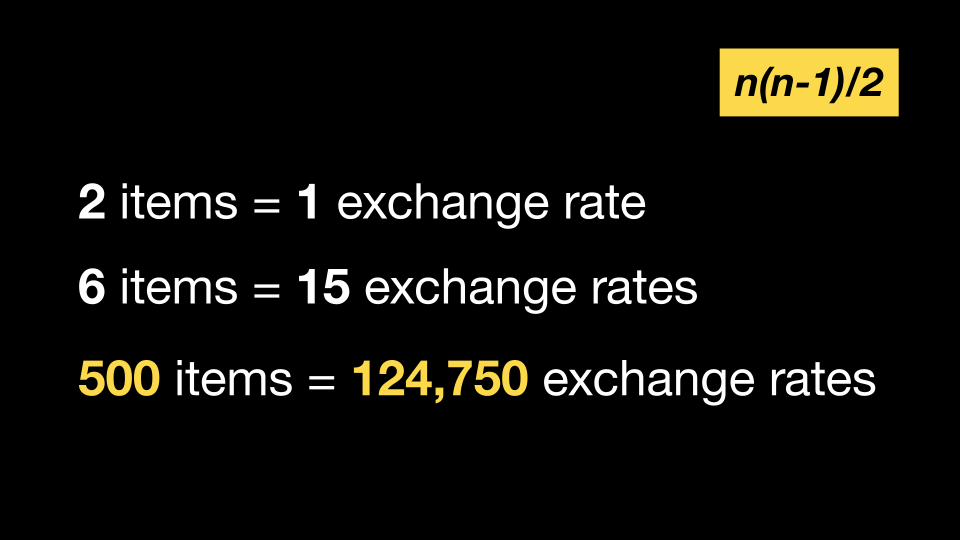

But an economy with just 500 unique items will have 124,750 exchange rates, making the barter system infeasible for a complex economy of millions of items.

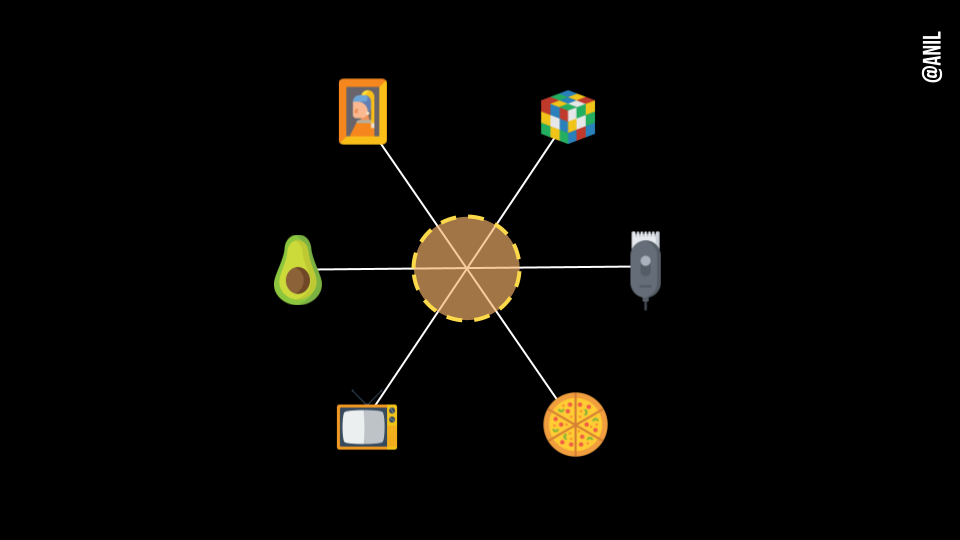

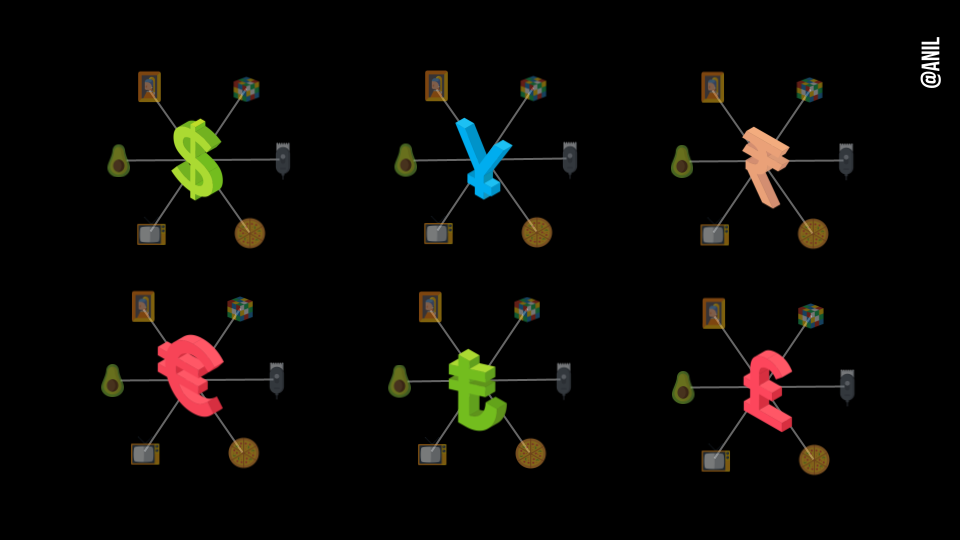

This problem (known as a coincidence of wants) is solved by using a single common medium between all transactions.

Usually, the most tradable good in a society is termed ‘money’.

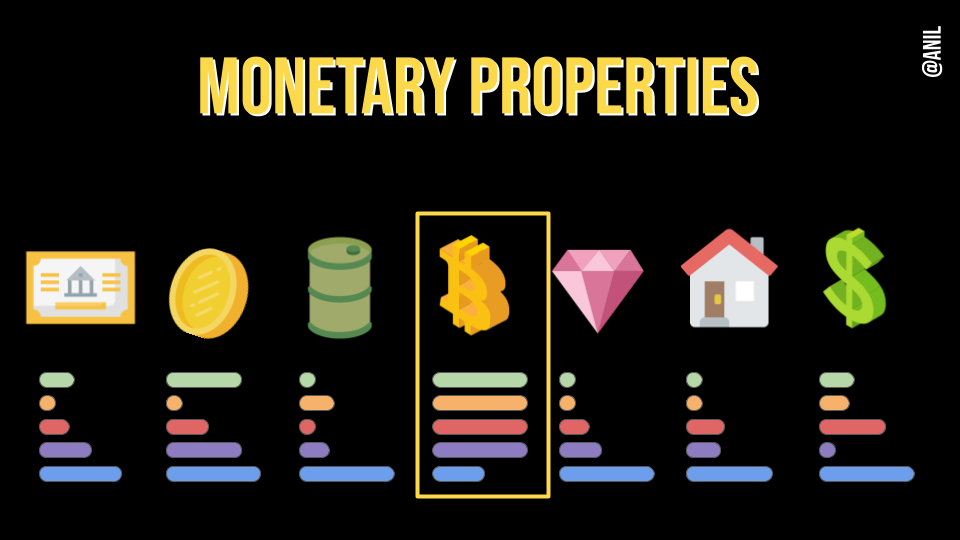

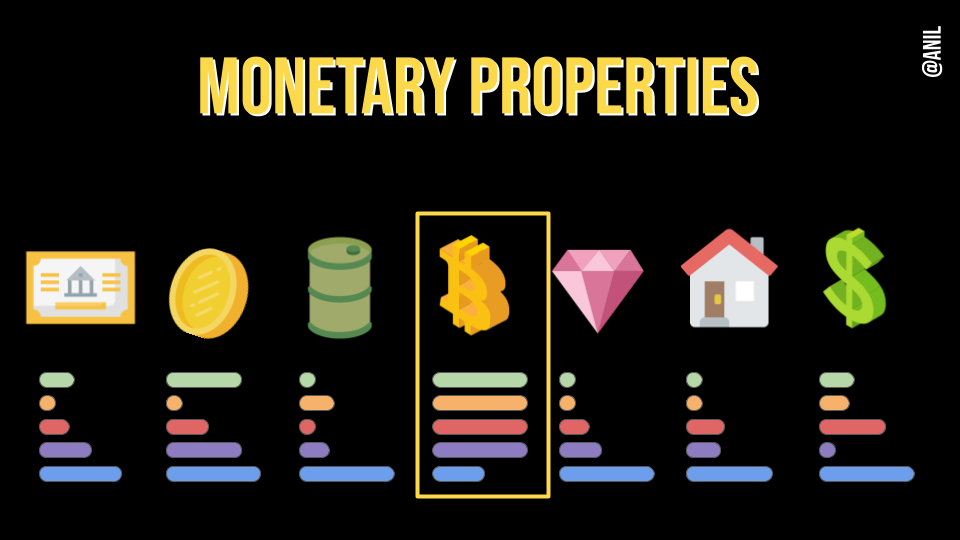

Previously, this was decided by the free-market, based on

a good’s monetary properties.

Today, it’s a top-down phenomena, imposed on citizens by sovereign governments.

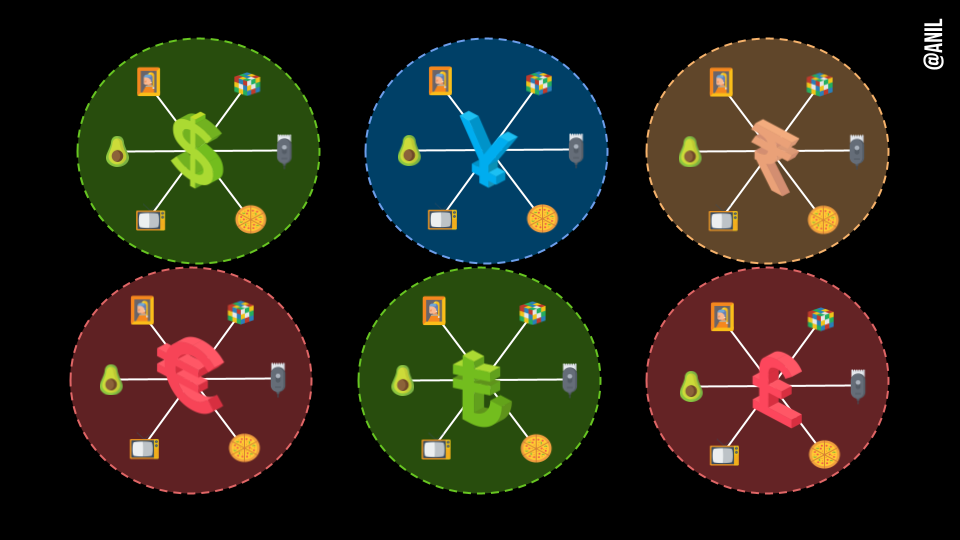

Money may differ in different places if there are significant enough barriers between them.

In the case of sovereign nations, a few things help create barriers and ensure a monetary monopoly: physical borders, capital controls, legal tender laws.

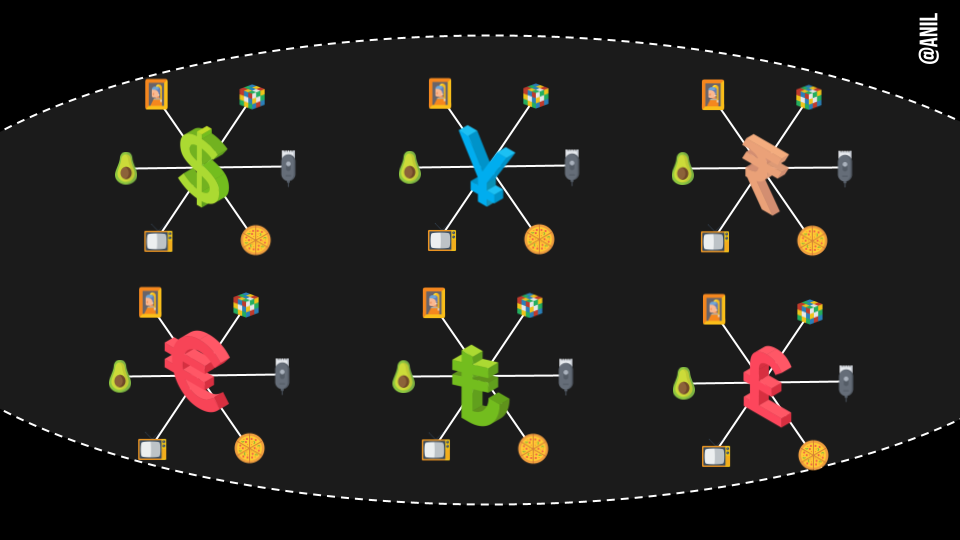

But we now have a global digital communications network (the internet).

This is breaking down borders and creating a single market, enabling international commerce at the level of the individual.

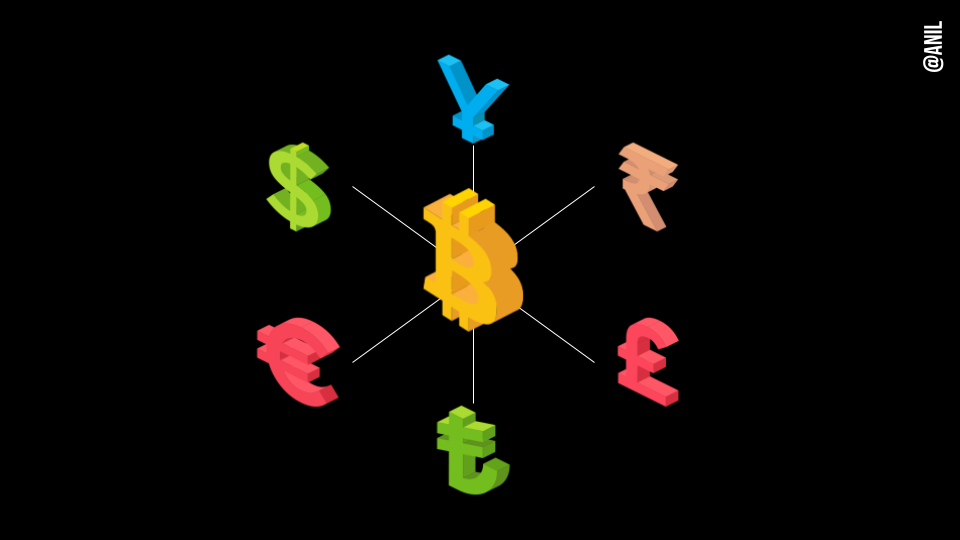

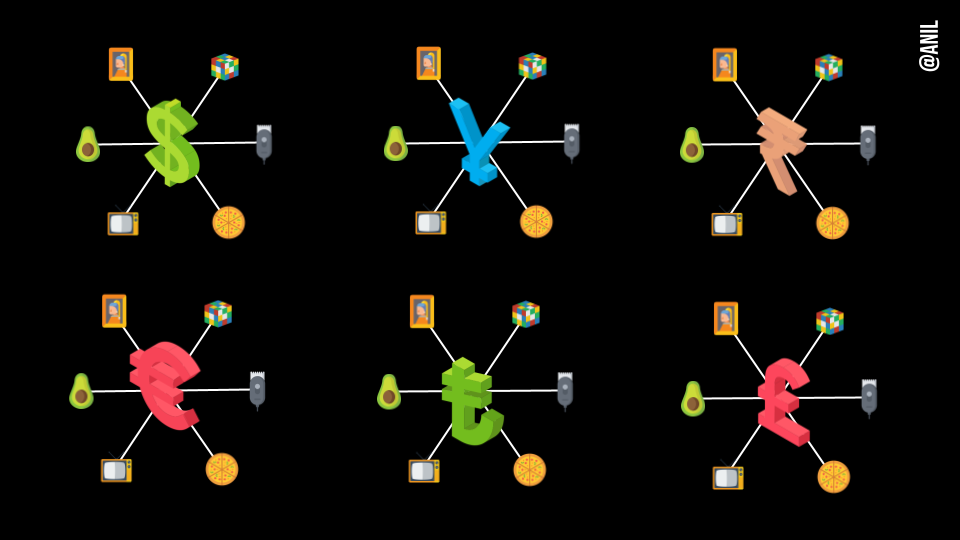

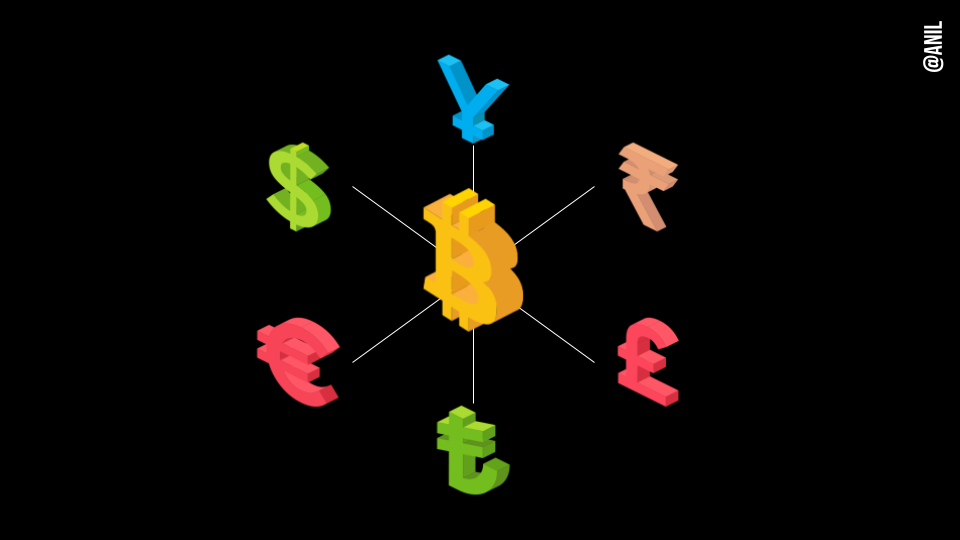

We now come across a similar version of our barter problem, but this time with the currencies themselves.

And once again we'll converge, this time on a single global monetary medium.

The chosen medium to bridge this gap will need to be:

1. Neutral (no single group has seigniorage)

2. Global (accessible everywhere)

3. Transparent (anyone can verify & audit)

4. Indestructible (cannot be shut down)

5. Peer-to-peer (enable commerce at the individual level)

By assessing the relative properties of all monetary goods, a winner emerges and the market converges.

Right now, all evidence points to that being bitcoin.

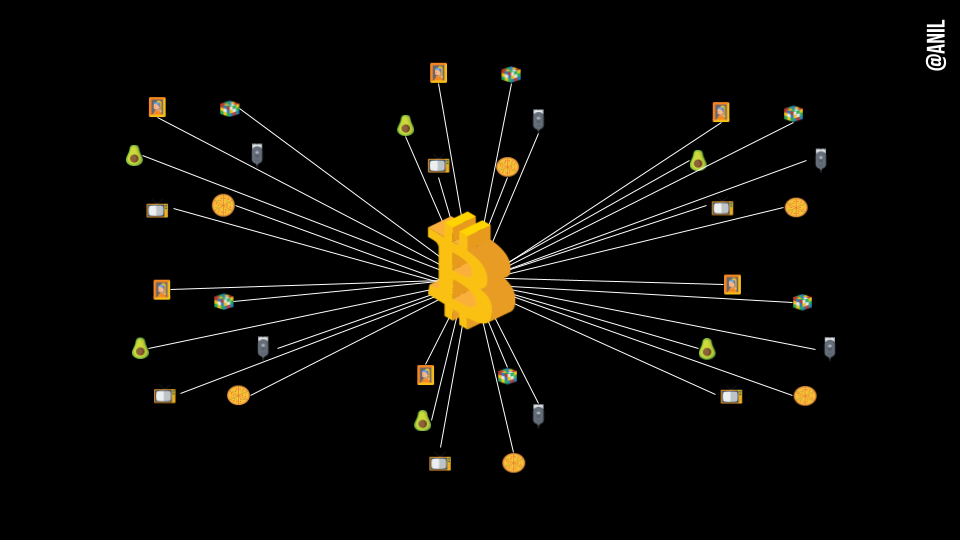

But it doesn’t end at simply intermediating currency exchanges.

Ultimately, we end up with a global economy, bypassing jurisdictionally-restricted money, transacting through one common digital monetary medium.

Thanks for reading.

Download these slides here:

https://tipybit.com/anilsaidso/products/why-money-converges-to-one

Let’s start with exchanging one good or service for another is a process known as barter exchange.

Let’s start with exchanging one good or service for another is a process known as barter exchange.

Barter can work at small scales.

Here’s an example with 6 unique items.

Barter can work at small scales.

Here’s an example with 6 unique items.

This economy of 6 items requires keeping track of 15 different exchange rates.

This economy of 6 items requires keeping track of 15 different exchange rates.

But an economy with just 500 unique items will have 124,750 exchange rates, making the barter system infeasible for a complex economy of millions of items.

But an economy with just 500 unique items will have 124,750 exchange rates, making the barter system infeasible for a complex economy of millions of items.

This problem (known as a coincidence of wants) is solved by using a single common medium between all transactions.

Usually, the most tradable good in a society is termed ‘money’.

This problem (known as a coincidence of wants) is solved by using a single common medium between all transactions.

Usually, the most tradable good in a society is termed ‘money’.

Previously, this was decided by the free-market, based on

a good’s monetary properties.

Previously, this was decided by the free-market, based on

a good’s monetary properties.

Today, it’s a top-down phenomena, imposed on citizens by sovereign governments.

Today, it’s a top-down phenomena, imposed on citizens by sovereign governments.

Money may differ in different places if there are significant enough barriers between them.

Money may differ in different places if there are significant enough barriers between them.

In the case of sovereign nations, a few things help create barriers and ensure a monetary monopoly: physical borders, capital controls, legal tender laws.

In the case of sovereign nations, a few things help create barriers and ensure a monetary monopoly: physical borders, capital controls, legal tender laws.

But we now have a global digital communications network (the internet).

This is breaking down borders and creating a single market, enabling international commerce at the level of the individual.

But we now have a global digital communications network (the internet).

This is breaking down borders and creating a single market, enabling international commerce at the level of the individual.

We now come across a similar version of our barter problem, but this time with the currencies themselves.

We now come across a similar version of our barter problem, but this time with the currencies themselves.

And once again we'll converge, this time on a single global monetary medium.

And once again we'll converge, this time on a single global monetary medium.

The chosen medium to bridge this gap will need to be:

1. Neutral (no single group has seigniorage)

2. Global (accessible everywhere)

3. Transparent (anyone can verify & audit)

4. Indestructible (cannot be shut down)

5. Peer-to-peer (enable commerce at the individual level)

The chosen medium to bridge this gap will need to be:

1. Neutral (no single group has seigniorage)

2. Global (accessible everywhere)

3. Transparent (anyone can verify & audit)

4. Indestructible (cannot be shut down)

5. Peer-to-peer (enable commerce at the individual level)

By assessing the relative properties of all monetary goods, a winner emerges and the market converges.

By assessing the relative properties of all monetary goods, a winner emerges and the market converges.

Right now, all evidence points to that being bitcoin.

Right now, all evidence points to that being bitcoin.

But it doesn’t end at simply intermediating currency exchanges.

Ultimately, we end up with a global economy, bypassing jurisdictionally-restricted money, transacting through one common digital monetary medium.

But it doesn’t end at simply intermediating currency exchanges.

Ultimately, we end up with a global economy, bypassing jurisdictionally-restricted money, transacting through one common digital monetary medium.

Thanks for reading.

Download these slides here:

Thanks for reading.

Download these slides here: