Time is the most scarce monetizable asset we all have.

Money, in whatever form, is merely the medium of exchange we buy or spend time.

Chasing money = spending time.

Creating flexibility = buying time.

Either way, time is the only finite resource available to us.

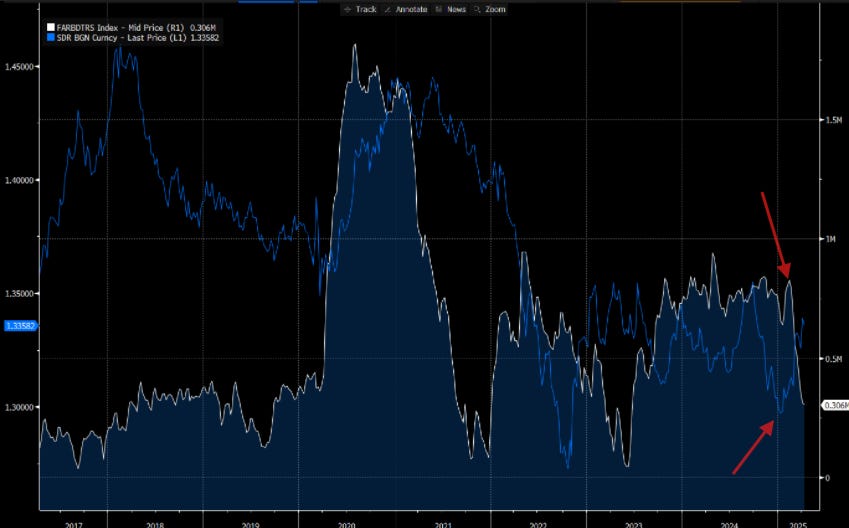

Since January 2024 - Bitcoin has paired up with DXY.

It has traded directionally with it. Breaking the trend of trading opposite.

i.e. we are seeing “yield curve control” but across Global Macro Asset classes not just the bond curve.