Why have prices gotten so high over the past couple of years? Is that annual ski trip starting to become a little over budget? The answer is simple.

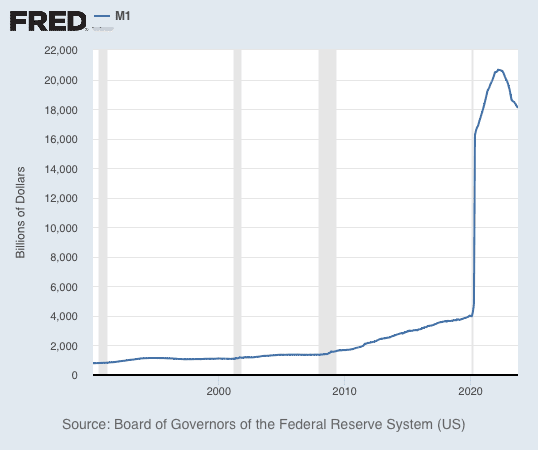

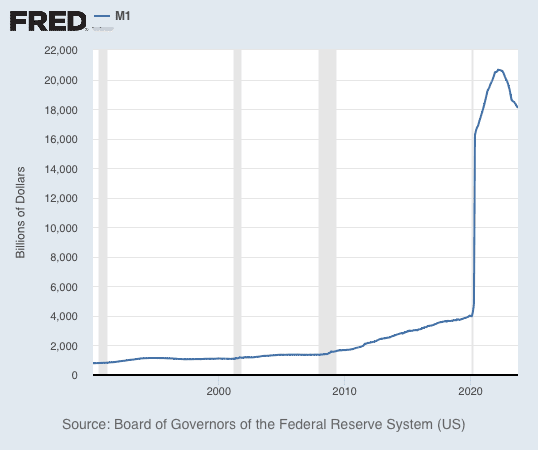

This is a chart of the M1 money supply. The M1 money supply is a measurement of the most liquid forms of money (cash, checking accounts, travelers checks, etc). I decided to use this measurement here because it best represents the money that is circulating through the economy. In 2020 we saw the M1 money supply skyrocket like never before.

Following this increase, the markets ripped. People were unable to go out and spend money since everything was closed, so what did they do? Everyone started throwing money into the stock market, crypto, and other investments.

Once things opened back up in 2021, we saw a lot of this new money travel into goods and services as people looked to spend again. The result… higher prices for everyone.

Increasing the money supply does not increase value, it just reprices everything higher. When the circulating money supply increases over 4x in a year, you can expect a substantial increase in the price of investments, goods & services, assets, etc over time.

#inflation #money #supply #economics

Disclaimer: This is not financial advice, this content is created for entertainment purposes only.