Small business owner that payed off business and wants to know what to do with excess money.

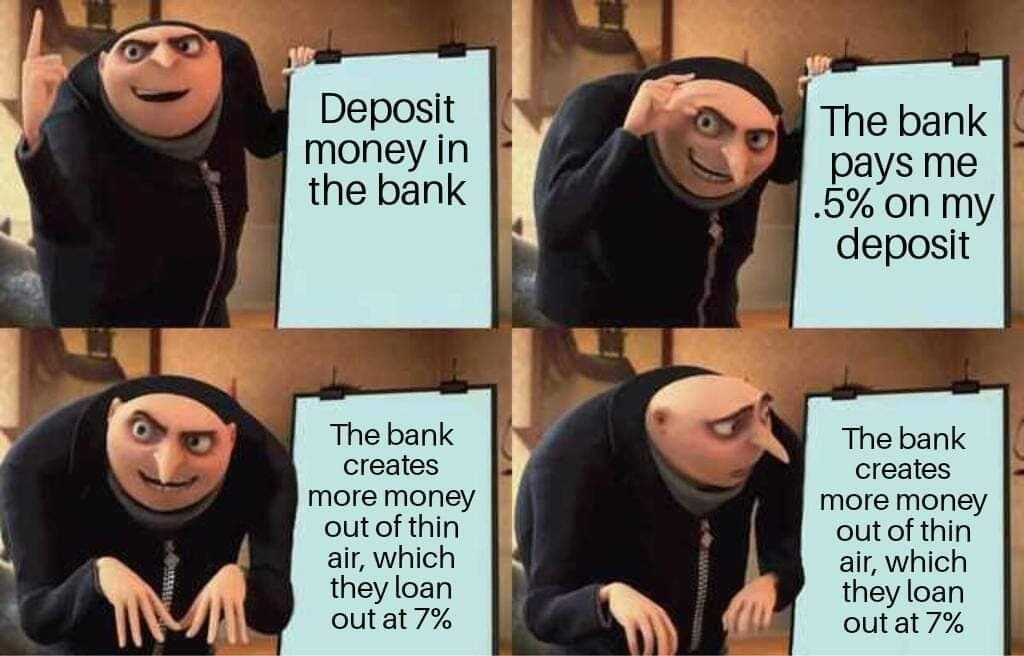

This sounds like the perfect candidate for implementing the Infinite Banking Concept... Most business owners struggle because of the lack of access to capital either in a crisis or in the event of a future opportunity that could be taken advantage of by having said guaranteed access to capital.

Secondly, The Infinite Banking Concept ™ is perfect for real estate investment as well as future business expansion. As said in the commentary, always invest in yourself first, the determine other investments that you are interested in and that you thoroughly understand.

My reply to this business owner, get and read the book Becoming Your Own Banker, as well as The Case for IBC, which is a newer book that is written in the eyes of a business owner. Links to the books in the comments.

Great job @Matthew Sercely

Fountain

Tax advice for a small business owner. • Clip by @michaelesparks • Listen on Fountain

Clipped from The Survival Podcast • Expert Council Q&A – Epi-3658

Today on The Survival Podcast the expert council answers your questions on c...