The next @Central Pennsylvania Bitcoiners Meetup is scheduled for this upcoming Sunday (2025-01-26) at Denim Coffee in Mechanicsburg, Pennsylvania from 13:00 to 15:00

Greetings Central PA Bitcoiners!

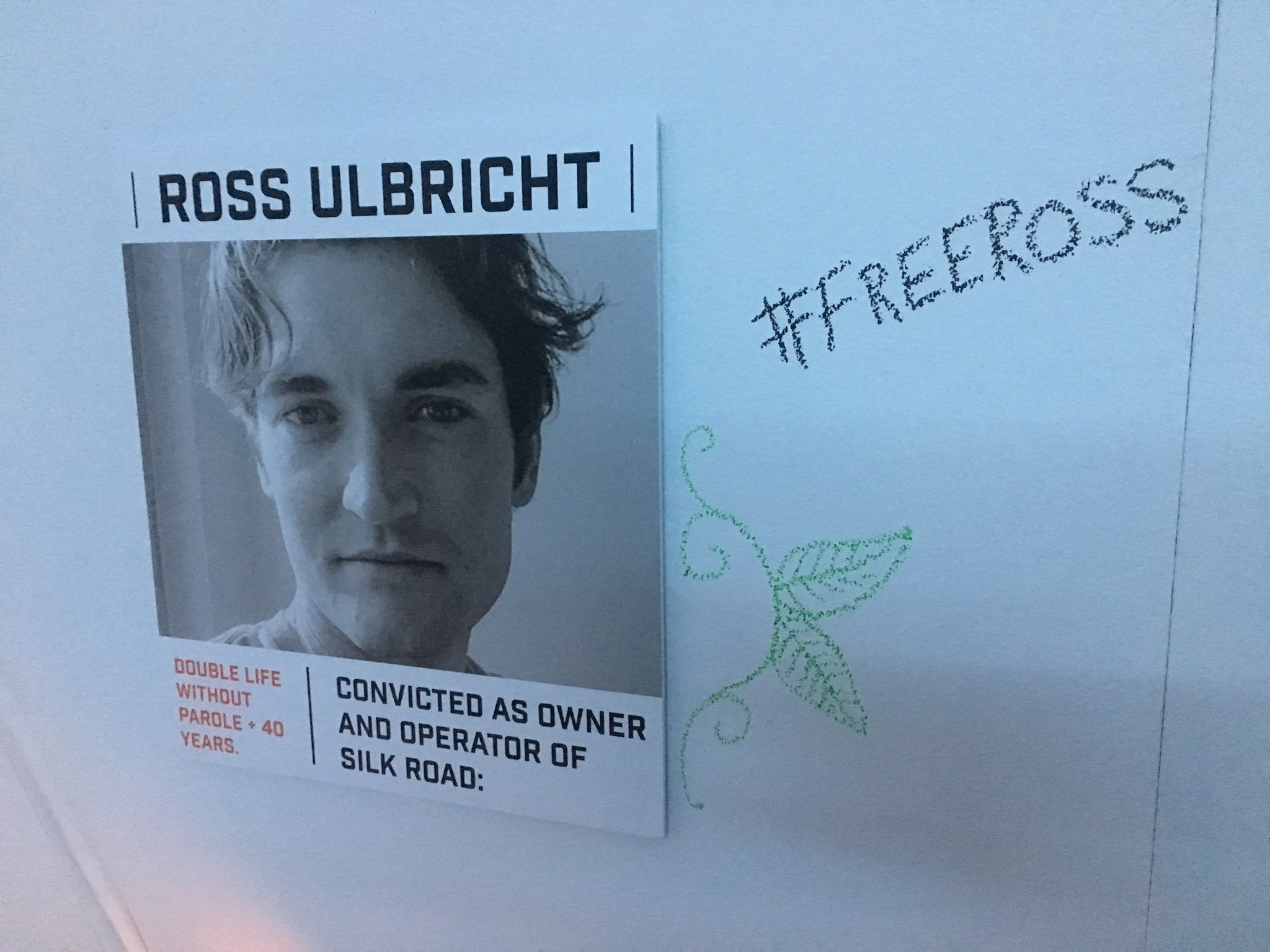

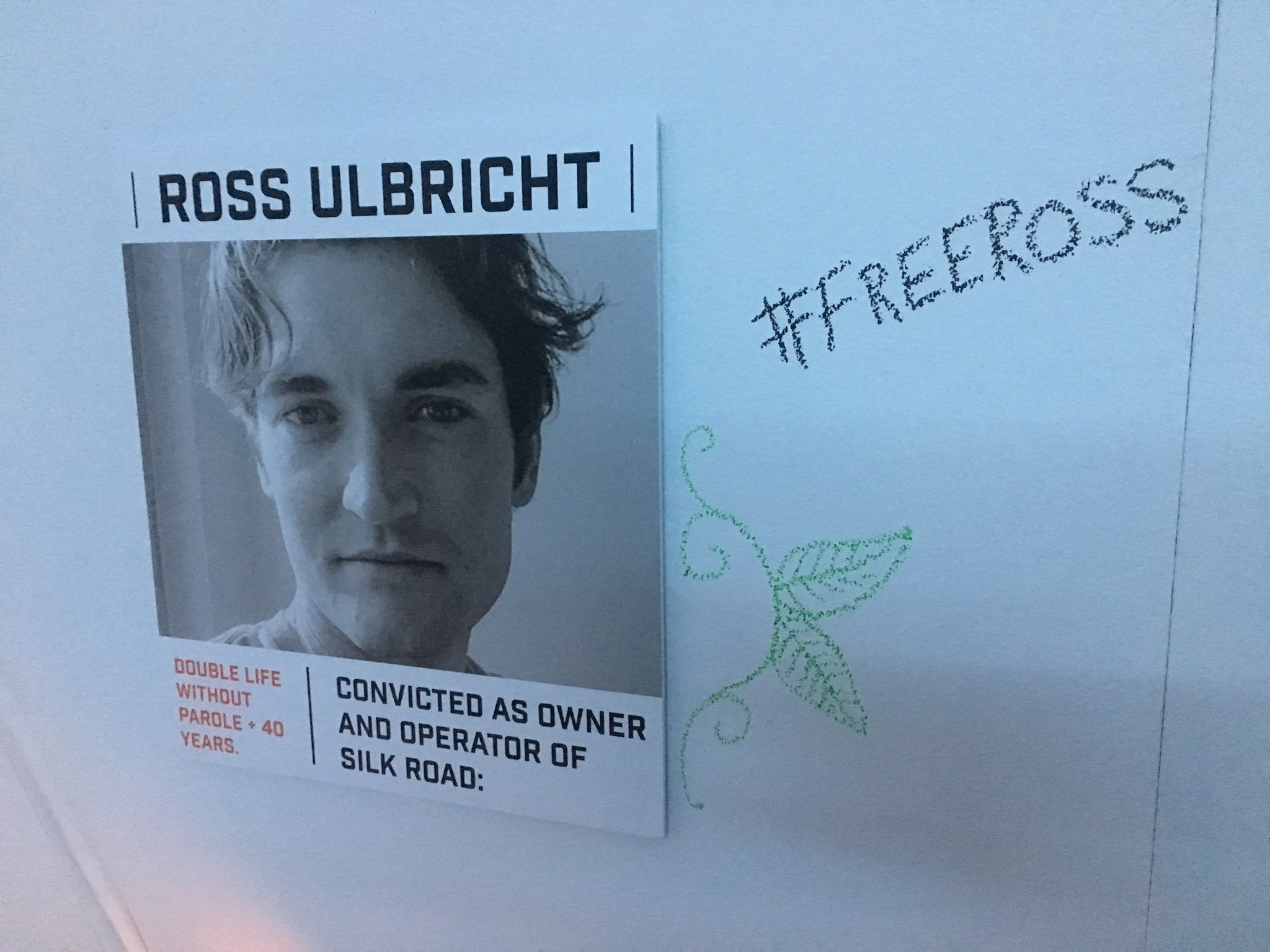

Last night we learned that Ross Ulbricht, creator of the original Silk Road marketplace, is receiving a full pardon.

This is a case that was closely watched by many bitcoiners and libertarians. The Silk Road was an online marketplace that was only accessible by using the tor browser, also known as a dark net market. This site served as an eBay for illicit items, mostly drugs. Like eBay, it used a user reputation system as well as an escrow system, minimizing the risk of purchasers getting scammed. Also, bitcoin served as the method of payment and escrow. Visa, Mastercard, Paypal and (if it had existed then) Venmo aren't options in such places on the internet.

Bitcoin has come a long way since its days keeping the Silk Road machine running over a decade ago. Many nocoiners still bring up its historic association with dark net markets as a negative, as something that should make people reluctant to acquire or interact with bitcoin.

This is a case that was closely watched by many bitcoiners and libertarians. The Silk Road was an online marketplace that was only accessible by using the tor browser, also known as a dark net market. This site served as an eBay for illicit items, mostly drugs. Like eBay, it used a user reputation system as well as an escrow system, minimizing the risk of purchasers getting scammed. Also, bitcoin served as the method of payment and escrow. Visa, Mastercard, Paypal and (if it had existed then) Venmo aren't options in such places on the internet.

Bitcoin has come a long way since its days keeping the Silk Road machine running over a decade ago. Many nocoiners still bring up its historic association with dark net markets as a negative, as something that should make people reluctant to acquire or interact with bitcoin.

Silk Road, as seemingly negative an association as it might be, was instrumental in bitcoin finding a use case early on in its history.

The best money shouldn't pass judgement on what it's being used for, whether that's making a purchase on the Silk Road, donating to protesting Canadian truckers, paying a female employee in much of the Arab world, or buying a Bible in North Korea. Local laws prohibit those transactions, and third party payment companies won't facilitate them for you. Is your money really yours if you have to ask someone else's permission on who you can pay with it, or what you can spend it on?

Fast forward 12 years from the Silk Road days, and both federal and state governments are making moves to add bitcoin onto their treasury balance sheets. California, Massachusetts, and Wyoming are the most recent announcements.

Silk Road, as seemingly negative an association as it might be, was instrumental in bitcoin finding a use case early on in its history.

The best money shouldn't pass judgement on what it's being used for, whether that's making a purchase on the Silk Road, donating to protesting Canadian truckers, paying a female employee in much of the Arab world, or buying a Bible in North Korea. Local laws prohibit those transactions, and third party payment companies won't facilitate them for you. Is your money really yours if you have to ask someone else's permission on who you can pay with it, or what you can spend it on?

Fast forward 12 years from the Silk Road days, and both federal and state governments are making moves to add bitcoin onto their treasury balance sheets. California, Massachusetts, and Wyoming are the most recent announcements.

As more and more entities recognize and admit that their cash reserves are consistently getting hammered by inflation, they'll want to adopt a similar strategy.

As more and more entities recognize and admit that their cash reserves are consistently getting hammered by inflation, they'll want to adopt a similar strategy.

Looking forward to our next meetup, which is at 1pm on this Sunday, Jan 26th, at Denim Coffee in Mechanicsburg. Hope to see you there!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Looking forward to our next meetup, which is at 1pm on this Sunday, Jan 26th, at Denim Coffee in Mechanicsburg. Hope to see you there!

@Lonelypumpkins

@Central Pennsylvania Bitcoiners

Trump Pardons Silk Road Founder Ross Ulbricht – Bitbo

President Trump granted a full pardon to Ross Ulbricht, founder of the Silk Road, vacating his life sentences and fulfilling a campaign promise.

Jamie Dimon Doubles Down:

JPMorgan CEO Jamie Dimon reiterates his harsh stance on Bitcoin, citing its alleged misuse in illegal activities and maintaining skepticism despite...

California, Massachusetts, and Wyoming Advance Bitcoin Reserve Plans – Bitbo

Wyoming, Massachusetts, and California are moving toward establishing state Bitcoin reserves, with proposed investments ranging from 3% to 10% of p...

BitcoinTreasuries.com

Track Bitcoin Treasuries of companies, miners and countries at BitcoinTreasuries.com.