Many people in the "crypto" space criticize #bitcoin for its "lack of utility" often claiming their preferred taste of #altcoin has "more utility".

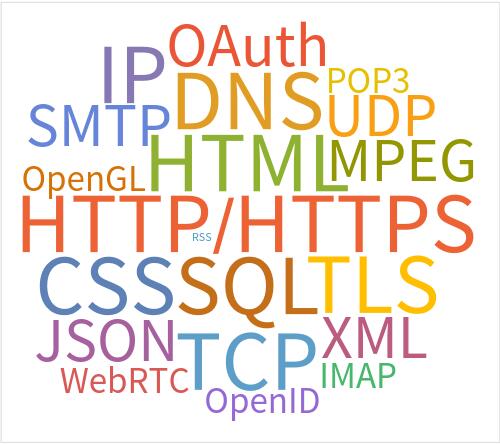

Ask yourself this: How did the open standards and protocols depicted in this image reach global adoption without having their own tokens that people need to buy if they want to make use of them?

There are more than 30K altcoin projects out there, all aiming to solve a certain problem, and most of them also claiming to become the standard for that specific functionality. The reality is that technically, virtually none of them require a token or a #blockchain. Most of them sacrifice real #decentralization for the hailed "more utility". In most cases, the token is an alternative method of raising funds and "buying adoption".

The only function that really requires a token is being #money. The rest are little more than glorified Air Miles, backed by billions in VC funding to make huge profits of those who don't understand this. Money is the killer app of blockchain technology. Any other applications that require value exchange or payment for services can easily integrate the open protocol that has the best and unchangeable monetary properties, with the largest network effect: Bitcoin.

Even ChatGPT acknowledges this distinction:

"Many altcoin projects introduce their native tokens, often for fundraising through Initial Coin Offerings (ICOs) or to incentivize network participation and security. However, the functionality of many blockchain projects could technically be achieved without a native token, using existing cryptocurrencies or traditional currencies for transaction fees and other necessary payments. The necessity of a native token typically depends on the project's goals, design, and economic model, and in many cases, the token serves primarily as a speculative asset or a means to raise funds rather than a functional component of the network.

Bitcoin, as the first cryptocurrency, was designed as a decentralized digital currency to enable peer-to-peer transactions without the need for a central authority or intermediary. Bitcoin's native token, BTC, is integral to its function. It serves as a medium of exchange, a unit of account, and a store of value. It incentivizes miners to secure the network through proof-of-work, rewarding them with newly minted bitcoins and transaction fees."