It’s #DecodingBitcoin time! Let’s go over the basic elements of a transaction.

Alice wants to send 5 BTC to Bob. She needs to create a bitcoin transaction using the unspent outputs (UTXOs) in her wallet.

UTXOs are unspent transaction outputs. They can be used as inputs for new transactions.

Think of them as "coins" in a wallet, waiting to be spent.

Alice checks her wallet and finds two UTXOs:

UTXOs are unspent transaction outputs. They can be used as inputs for new transactions.

Think of them as "coins" in a wallet, waiting to be spent.

Alice checks her wallet and finds two UTXOs:

To create a transaction, Alice has to specify exactly which UTXOs to spend.

A UTXO is identified by the transaction it came from, specifically

- the transaction ID and

- an index that says where the UTXO is in the list of transaction outputs

To create a transaction, Alice has to specify exactly which UTXOs to spend.

A UTXO is identified by the transaction it came from, specifically

- the transaction ID and

- an index that says where the UTXO is in the list of transaction outputs

Wallets usually store this information for you but you can also look it up on the blockchain.

Alice's wallet shows these available UTXOs:

- UTXO #1: 4 BTC (from Transaction 1, Output Index 1)

- UTXO #2: 2 BTC (from Transaction 2, Output Index 0)

Together, they provide enough funds (4 BTC + 2 BTC = 6 BTC) for the payment and any transaction fees.

Now Alice has everything she needs to identify her UTXOs. As she adds them to the transaction, she saves space for the signatures she will make later. These signatures authorize the spending of the UTXOs.

Wallets usually store this information for you but you can also look it up on the blockchain.

Alice's wallet shows these available UTXOs:

- UTXO #1: 4 BTC (from Transaction 1, Output Index 1)

- UTXO #2: 2 BTC (from Transaction 2, Output Index 0)

Together, they provide enough funds (4 BTC + 2 BTC = 6 BTC) for the payment and any transaction fees.

Now Alice has everything she needs to identify her UTXOs. As she adds them to the transaction, she saves space for the signatures she will make later. These signatures authorize the spending of the UTXOs.

Now that the transaction inputs have been taken care of, it’s time to look at the outputs!

Alice needs to create two outputs:

- 5 BTC to Bob (the payment amount)

- 0.99 BTC back to Alice as change (there is a 0.01 BTC transaction fee)

Now that the transaction inputs have been taken care of, it’s time to look at the outputs!

Alice needs to create two outputs:

- 5 BTC to Bob (the payment amount)

- 0.99 BTC back to Alice as change (there is a 0.01 BTC transaction fee)

Why do we have to make a separate output for change?

UTXOs must be spent in their entirety. You cannot partially spend a UTXO. Instead, you create a new output that sends the excess amount back to yourself as change.

Why do we have to make a separate output for change?

UTXOs must be spent in their entirety. You cannot partially spend a UTXO. Instead, you create a new output that sends the excess amount back to yourself as change.

Looks good! The transaction structure is now complete, but it’s not yet valid. Alice must sign it to prove she owns the inputs. We’ll cover that in a future lesson 🙂

Follow us @Bitcoin Dev Project to stay updated!

This material is from Decoding Bitcoin, your go-to resource for understanding #bitcoin, privacy, and decentralization.

If you enjoyed it, visit

Looks good! The transaction structure is now complete, but it’s not yet valid. Alice must sign it to prove she owns the inputs. We’ll cover that in a future lesson 🙂

Follow us @Bitcoin Dev Project to stay updated!

This material is from Decoding Bitcoin, your go-to resource for understanding #bitcoin, privacy, and decentralization.

If you enjoyed it, visit  for the full lesson, and more free, interactive content.

Thanks for reading!

for the full lesson, and more free, interactive content.

Thanks for reading!

UTXOs are unspent transaction outputs. They can be used as inputs for new transactions.

Think of them as "coins" in a wallet, waiting to be spent.

Alice checks her wallet and finds two UTXOs:

UTXOs are unspent transaction outputs. They can be used as inputs for new transactions.

Think of them as "coins" in a wallet, waiting to be spent.

Alice checks her wallet and finds two UTXOs:

To create a transaction, Alice has to specify exactly which UTXOs to spend.

A UTXO is identified by the transaction it came from, specifically

- the transaction ID and

- an index that says where the UTXO is in the list of transaction outputs

To create a transaction, Alice has to specify exactly which UTXOs to spend.

A UTXO is identified by the transaction it came from, specifically

- the transaction ID and

- an index that says where the UTXO is in the list of transaction outputs

Wallets usually store this information for you but you can also look it up on the blockchain.

Alice's wallet shows these available UTXOs:

- UTXO #1: 4 BTC (from Transaction 1, Output Index 1)

- UTXO #2: 2 BTC (from Transaction 2, Output Index 0)

Together, they provide enough funds (4 BTC + 2 BTC = 6 BTC) for the payment and any transaction fees.

Now Alice has everything she needs to identify her UTXOs. As she adds them to the transaction, she saves space for the signatures she will make later. These signatures authorize the spending of the UTXOs.

Wallets usually store this information for you but you can also look it up on the blockchain.

Alice's wallet shows these available UTXOs:

- UTXO #1: 4 BTC (from Transaction 1, Output Index 1)

- UTXO #2: 2 BTC (from Transaction 2, Output Index 0)

Together, they provide enough funds (4 BTC + 2 BTC = 6 BTC) for the payment and any transaction fees.

Now Alice has everything she needs to identify her UTXOs. As she adds them to the transaction, she saves space for the signatures she will make later. These signatures authorize the spending of the UTXOs.

Now that the transaction inputs have been taken care of, it’s time to look at the outputs!

Alice needs to create two outputs:

- 5 BTC to Bob (the payment amount)

- 0.99 BTC back to Alice as change (there is a 0.01 BTC transaction fee)

Now that the transaction inputs have been taken care of, it’s time to look at the outputs!

Alice needs to create two outputs:

- 5 BTC to Bob (the payment amount)

- 0.99 BTC back to Alice as change (there is a 0.01 BTC transaction fee)

Why do we have to make a separate output for change?

UTXOs must be spent in their entirety. You cannot partially spend a UTXO. Instead, you create a new output that sends the excess amount back to yourself as change.

Why do we have to make a separate output for change?

UTXOs must be spent in their entirety. You cannot partially spend a UTXO. Instead, you create a new output that sends the excess amount back to yourself as change.

Looks good! The transaction structure is now complete, but it’s not yet valid. Alice must sign it to prove she owns the inputs. We’ll cover that in a future lesson 🙂

Follow us @Bitcoin Dev Project to stay updated!

This material is from Decoding Bitcoin, your go-to resource for understanding #bitcoin, privacy, and decentralization.

If you enjoyed it, visit

Looks good! The transaction structure is now complete, but it’s not yet valid. Alice must sign it to prove she owns the inputs. We’ll cover that in a future lesson 🙂

Follow us @Bitcoin Dev Project to stay updated!

This material is from Decoding Bitcoin, your go-to resource for understanding #bitcoin, privacy, and decentralization.

If you enjoyed it, visit

Decoding Bitcoin

Simplifying bitcoin tech to help you learn as efficiently as possible

Here's how to calculate the fee for this transaction:

Here's how to calculate the fee for this transaction:

Fees incentivise miners to include transactions in blocks. Without fees, miners would have little reason to put transactions into blocks!

In addition to fees, miners also receive a block reward.

Total miner revenue = fees + block reward

Fees incentivise miners to include transactions in blocks. Without fees, miners would have little reason to put transactions into blocks!

In addition to fees, miners also receive a block reward.

Total miner revenue = fees + block reward

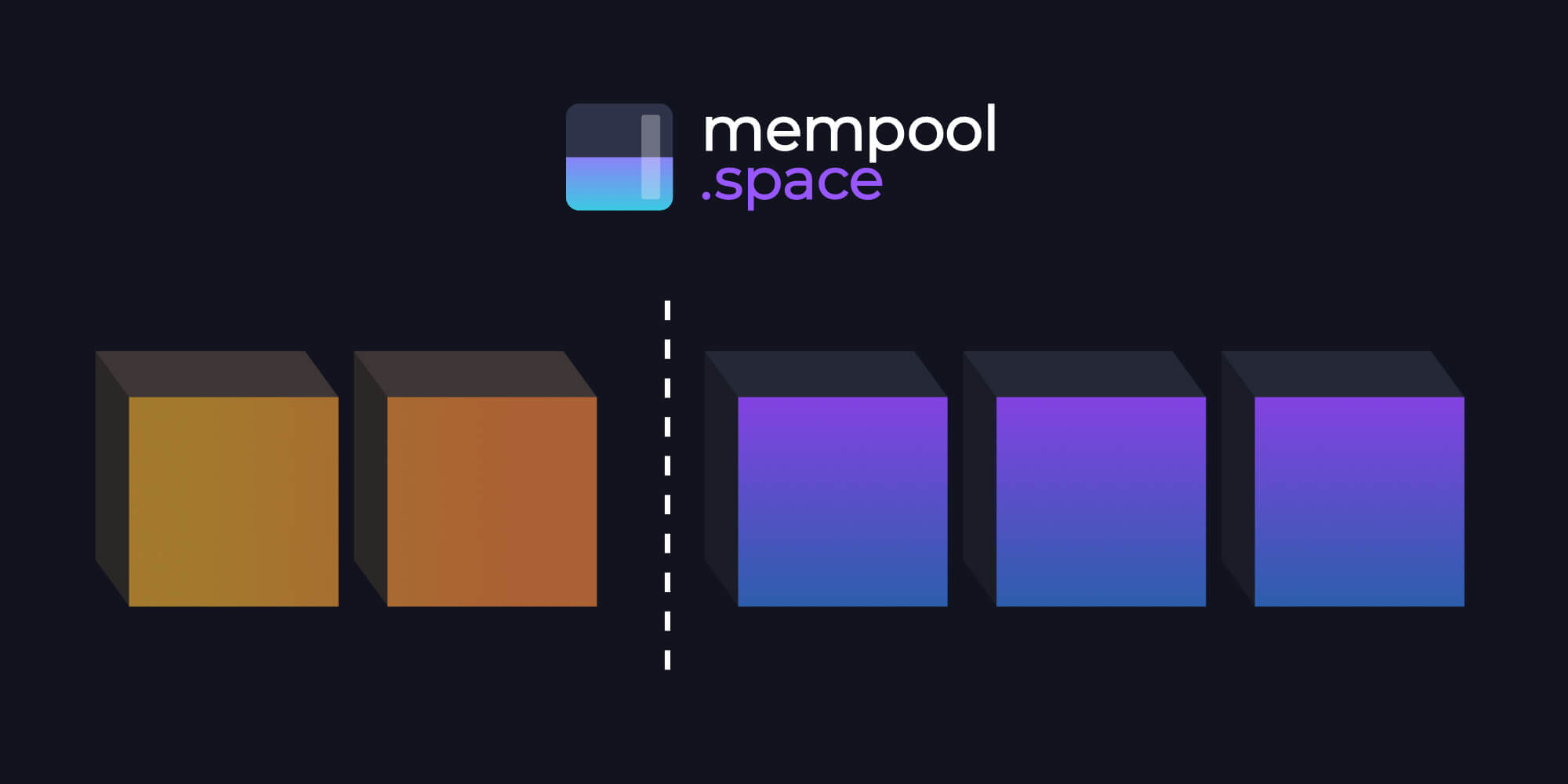

How do miners decide what transactions go into a block?

The short answer is miners will usually maximize revenue by prioritizing transactions with the highest fee rate (we've got a whole lesson fee rates coming!)

How do miners decide what transactions go into a block?

The short answer is miners will usually maximize revenue by prioritizing transactions with the highest fee rate (we've got a whole lesson fee rates coming!)

While miners can choose which transactions to include based on fees, there's a minimum threshold, a "minimum relay fee" that must be met just for a transaction to be relayed through the network.

Transactions below this threshold are rejected by nodes. It helps prevent spam and DoS attacks on the network

While miners can choose which transactions to include based on fees, there's a minimum threshold, a "minimum relay fee" that must be met just for a transaction to be relayed through the network.

Transactions below this threshold are rejected by nodes. It helps prevent spam and DoS attacks on the network

This brings us to an important question: What happens if you submit a transaction with a fee rate above the minimum but still too low for current network conditions?

That transaction could sit in the mempool for hours because the fee rate is too low for the high level of network activity. Even if you met the minimum, there can still be plenty of transactions with higher fee rates than yours, ones that miners will choose first.

This brings us to an important question: What happens if you submit a transaction with a fee rate above the minimum but still too low for current network conditions?

That transaction could sit in the mempool for hours because the fee rate is too low for the high level of network activity. Even if you met the minimum, there can still be plenty of transactions with higher fee rates than yours, ones that miners will choose first.

At this point, you have two main ways to "unstick" it:

1. RBF (Replace-by-Fee)

2. CPFP (Child Pays for Parent)

--------------------------------

That's all for now! We'll dive deeper into fee rates, RBF, and CPFP in a future post.

This material is from Decoding Bitcoin, your go-to resource for understanding #bitcoin, privacy, and decentralization.

If you enjoyed it, visit

At this point, you have two main ways to "unstick" it:

1. RBF (Replace-by-Fee)

2. CPFP (Child Pays for Parent)

--------------------------------

That's all for now! We'll dive deeper into fee rates, RBF, and CPFP in a future post.

This material is from Decoding Bitcoin, your go-to resource for understanding #bitcoin, privacy, and decentralization.

If you enjoyed it, visit