How Bitcoin Can Preserve The Life Savings Of Refugees

Josef Tětek

May 28, 2023

Bitcoin’s unique properties make it the best way to preserve wealth in a time of crisis. But there are some things to keep in mind to prepare.

Bitcoin Magazine

How Bitcoin Can Preserve The Life Savings Of Refugees

Bitcoin’s unique properties make it the best way to preserve wealth in a time of crisis. But there are some things to keep in mind to prepare.

This is an opinion editorial by Josef Tětek, a Bitcoin analyst at Trezor.

Suppose you lead an ordinary family life in an undisclosed country. Suddenly, a crisis hits. This could be the rise of an autocratic regime, a democide or an armed conflict. Whatever the circumstances, you will most likely have two pressing problems on your mind. First and foremost, you need to get everyone to safety, preferably abroad. Second, you need to preserve as much of your savings as possible to set up your life elsewhere. Since a safe escape from a disaster-stricken country depends heavily on individual circumstances, this article will focus on a savings preservation strategy that is globally applicable.

Preserving Your Savings The Traditional Way

Protecting the value of one’s savings while fleeing a country has never been easy. Those fortunate enough to have had any wealth before a crisis strikes may find it difficult to save it when there is a sudden need to leave the country.

Real Estate

So, you own your house, and chances are that you have benefited greatly from the easy money policies of the past decade as it has grown a lot in value over the years. You may be moderately well off on paper, but how easy is it to actually turn your house into money in a short time frame? The market demand might be heavily impacted by the very crisis that is forcing you to flee — for example in a case of foreign invasion, the demand for houses in the affected region will come to a halt, while the number of homeowners looking to sell will skyrocket. So, unless you foresaw a crisis looming ahead and sold before others, chances are you won’t be able to extract much of your home’s value when you need it the most.

Savings In The Bank

But let’s say you had good foresight and sold your house in time. Now you have a lot of money in the bank. Again, if the crisis affects the entire country, chances are you won't be able to withdraw or move your money fast enough. There are many examples in history where a "bank holiday" was announced and depositors were denied their money when they needed it the most. One of the more recent examples comes from Lebanon, where banks simply shut their doors and ATMs [1] to prevent clients from withdrawing their money in the midst of an ongoing economic crisis. If you think you can protect yourself against a national currency’s devaluation by owning a dollar account, you better think twice: In Lebanon, the dollar accounts were forcefully converted to a Lebanese pound that had lost 97% of its value against the dollar since 2019 [2]. In fact, bank accounts may not be safe anywhere, as banks around the world operate in fractional-reserve mode, making them vulnerable to runs and subsequent collapses. Recent collapses of a trio of U.S. banks [3] — Silvergate Bank, Signature Bank and Silicon Valley Bank — have proven this vulnerability.

However, it's worth noting that there is usually a several days’ delay between an emerging crisis and a full-blown bank holiday. If you suspect that banks might prohibit you from accessing your money soon, you can use this window of opportunity to withdraw your money in the form of cash or quickly convert it into bitcoin while it's still possible.

Cash

Let’s say you withdrew all of your money and kept it in cash. Hopefully, it’s in dollars or euros, as otherwise it might be hard to find a use for your local currency abroad, especially if the crisis that forced you to leave impacts the exchange rate, as it often does — the Ukrainian hryvnia has devalued by 25% [4] since the start of the Russian invasion.

Traveling with large amounts of dollars or euros also involves risks, though. The first of those is a risk of theft, either by common criminals or corrupt border patrols. The second risk is that, if you’re traveling with cash worth more than $10,000 or the equivalent in euros, you need to declare them when crossing the borders of many countries, including the U.S. [5] Failure to declare can result in the confiscation of the full amount.

Did you know that the U.S. customs guards confiscate more than $200,000 from travelers on average every day? [6] And if you do in fact declare that you’re traveling with large amounts of cash, you never know where that information might end up — sensitive data that is collected can also leak. For example, in 2020, there was a major leak of detailed personal data [7], including the property records of 200 million Americans. Criminals can use this data for targeted attacks.

Cash is also getting gradually useless in the western world. In the euro area, cash usage fell [8] from accounting for 72% of all point-of-sale transactions in 2019 to 59% in 2022, and this trend is encouraged by governments that impose strict cash limits. So, even if you make it abroad with your savings in the form of cash, you’ll likely need to set up a bank account fast, which might not be a straightforward or easy task for a new migrant.

Gold

Gold used to be the most popular way to transfer value intact in the past, given that it has a worldwide demand and can be sold at relatively little discount (assuming investment-grade coins or bars are being used). Gold is also quite dense in value, as the price of 1 kilogram of gold is around $60,000 at the time of this writing [9]. Otherwise, it faces the same risks as cash as it can be easily stolen along the way. Moreover, gold isn’t accepted as a means of payment and isn’t divisible, so you’d need to exchange your full coins or bars into the local currency after you arrive in your destination country.

Stocks And Bonds

Stocks and bonds are great fair-weather instruments, but they might become as useless as bank accounts when things get hairy. Local stocks and bonds will likely be worthless abroad and their value might be impacted by the given crisis. International financial instruments (e.g., U.S.-based exchange-traded funds) would fare better, though such instruments aren’t available in most parts of the world. And even if they are available to you, access to these instruments may be affected by newly-imposed sanctions.

Does Bitcoin Fix This?

You might have noticed that all of the usual instruments for wealth preservation have common traits in the form of limited transferability and/or value tied to a specific location or jurisdiction. Physical instruments such as cash and gold always carry a risk of loss or theft along the way, while intangible instruments such as real estate, bank accounts and stocks are, for the most part, valuable only locally.

Bitcoin indeed fixes this.

First, bitcoin is intangible and is therefore very easy to transfer. You can either send bitcoin to anyone globally within minutes, or you can remember the recovery seed and literally carry the bitcoin in your head (though that carries its specific risks as well, as we’ll cover below). Compared to other intangible assets, such as bank or brokerage accounts, there is no counterparty risk — you never need to worry about your money becoming inaccessible due to bank holidays, institutional failures or newly-imposed sanctions.

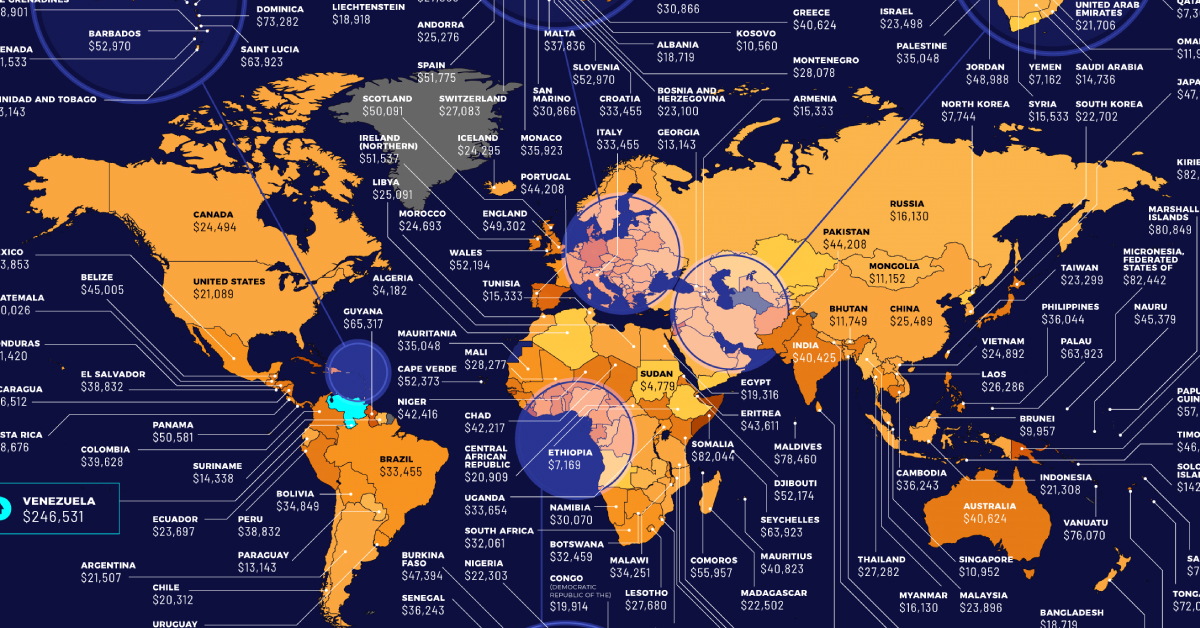

Second, bitcoin is a global asset, and as such, its value isn’t linked to any specific jurisdiction. A good example of this fact is the 2021 bitcoin mining ban in China [10], which seemed like a big deal at the time, since most bitcoin mining operations were located in China. Nevertheless, bitcoin miners simply moved elsewhere, and there was virtually no impact on the price (on the contrary, bitcoin reached new highs several months after the ban [11]).Bitcoin is a global asset, but unlike gold, it can be bought or sold in all kinds of ways — on regulated exchanges, on decentralized exchanges, in ATMs, or from person to person; and the chances are, you will face a minimum spread on your exchanges.

Bitcoin’s intangibility, zero reliance on third parties and global liquidity makes it a perfect candidate for savings preservation in critical situations.

So, what are the specific methods for using bitcoin when fleeing a country?

Traveling With Bitcoin Safely

The main concern when traveling with bitcoin is to eliminate a single point of failure. If you just write down your recovery seed and put it in your back pocket, you undertake a great risk, as anyone who sees, takes or photographs your recovery seed has the ability to steal all your bitcoin. To travel safely with bitcoin, you need to minimize the possibility of loss or theft. Below are some tips on how to tackle this problem.

Bitcoin In Your Mind

To keep access to your bitcoin, the only thing you need to do is remember your recovery seed i.e., an ordered list of English words that is either 12- or 24-words long. Remembering 12 words is obviously easier than remembering 24 words, so it’s advisable to go for that option (e.g., by generating your seed on a Trezor Model T, which supports this format). Use a memory-enhancement technique such as the memory palace [12]. If you’re traveling with your family, have all the family members remember the same recovery seed; that way, if someone forgets some of the words, you’ll still be able to reconstruct the full seed.

After you memorize your seed, try recovering your bitcoin in an offline wallet, preferably a hardware device (on Trezor devices, you can perform a dry run recovery [13] that doesn’t wipe the device). Once you’re certain you have your recovery seed firmly embedded in your memory, wipe the wallet. If you want to carry your hardware wallet with you on your travels, make sure it is wiped, so that if you lose it or someone takes it away from you, there will be no possibility of its misuse.

On arrival, recover your bitcoin again in the wallet of your choice (make sure you type in your seed in an offline environment though!).

Don’t rely on your memory for longer periods. Traveling in an adversarial environment is the only situation when relying on your memory might be a good idea, but aim to minimize the time span in which you store your recovery seed in your head. For long-term storage, always write your seed down, or better yet, stamp or engrave it into steel (there are many products for this on the market; before you make a purchase, I recommend checking out Jameson Lopp’s stress tests [14]).

Relying On Your Web Of Trust

Another way to transfer your wealth via bitcoin is to simply send it as a bitcoin transaction to someone you trust. The person doesn’t even have to be in the country you aim to travel to; the important thing is that they will be able to keep your bitcoin safe during your travels, and send it back to you when you’re able to set up your new wallet in a safe environment. The most important factor here is trust. This may be off-putting to some (after all, we all know the mantra of “don’t trust, verify”), but the fact is that for some people this may be the way to go if they don’t want to rely on their memory and are certain that the person on the other side would never betray them. The person you’re sending your bitcoin to needs to be proficient in bitcoin, and ideally should own a well backed-up hardware wallet — after all, you don’t want them to hold your life savings on their mobile phones, right?

If you want to increase the security of this process, you can do so via a multisig wallet. Let’s say you set up a two-out-of-three multisig wallet and transfer your bitcoin into such a wallet. Now you can send one of the keys to Person A, the second one to Person B and carry the third one with you. Person A and Person B shouldn’t know about each other, so that there is no way to steal the bitcoin that is stored in this way. And if you lose your key during your travels, you will still be able to recover your bitcoin using the keys of Person A and Person B. You can set up your multisig wallet using Electrum, Sparrow or Nunchuk. To distribute the keys, make sure to use a secure, encrypted communicator such as Signal [15] messenger (do not use Telegram, as it isn’t encrypted by default! [16]).

Alternatively, you can utilize a Shamir backup, a cryptographically-sound method for splitting your recovery seed into multiple shares (use time-tested wallets such as the Trezor Model T to do this safely). Let’s say you do a two-out-of-three Shamir backup — the next steps are the same as we described above with multisigs. It’s advisable to reinforce the security of your Shamir backup by setting up a passphrase [17] on top of it.

Plausible Deniability

Ideally, there should be no indication that you are a Bitcoiner. That means carrying no hardware wallets, having no Bitcoin stickers on your laptop or phone, not carrying any Bitcoin books and deleting any Bitcoin/cryptocurrency apps from your phone. Do not talk about bitcoin with strangers or the border guards. If someone asks a seemingly-innocent question about bitcoin or cryptocurrencies, act ignorant or just say that you think it’s a scam. Simply said, you should look and act as a “normie.”

Do Not Rely On Exchanges

Some readers might be tempted to use their bitcoin exchange account — after all, you can log into it from anywhere in the world, right? I personally strongly advise against relying on exchanges with any portion of your savings. Aside from frequent exchange failures (just in the last twelve months, we saw the collapses of FTX [18], Celsius [19] and BlockFi [20], and a freeze on Gemini Earn [21] users), the exchange may block your funds, for example, because of sanctions or logging in from an IP address in a "wrong" country. In short, if you hold your bitcoin on an exchange, you don't really own it.

Not Just A Theory Anymore

Bitcoin is already used as a means of preserving one's savings in times of crisis. In recent years, we have seen success stories of this kind from countries as diverse as Afghanistan [22], Venezuela [23] and Ukraine [24]. Due to its global liquidity and direct controllability, bitcoin is proving to be a valuable tool in critical situations. The more knowledgeable you are about the safe transfer of bitcoin, the better prepared you'll be in the event of such a situation arising.

This is a guest post by Josef Tětek. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Links:

[1]

AP News

Lebanese banks close doors to customers to protest ruling

BEIRUT (AP) — Lebanon's battered commercial banks on Tuesday closed their doors to customers in protest of a recent court ruling that forced one ...

[2]

AP News

Lebanese banks close doors to customers to protest ruling

BEIRUT (AP) — Lebanon's battered commercial banks on Tuesday closed their doors to customers in protest of a recent court ruling that forced one ...

[3]

https://www.forbes.com/sites/digital-assets/2023/03/17/regulators-shut-down-banks-raising-questions-about-neutrality/?sh=ddc2b5b71853

[4]

https://www.reuters.com/markets/rates-bonds/ukraines-central-bank-devalues-hryvnia-by-25-against-us-dollar-2022-07-21/

[5]

https://help.cbp.gov/s/article/Article-195?language=en_US

[6]]

U.S. Customs and Border Protection

Dulles CBP Officers Seize over $350k during 14 Currency Reporting Violations Since New Year’s Eve

Securing America's Borders

[7]

The Hacker News

A Massive U.S. Property and Demographic Database Exposes 200 Million Records

A New Massive U.S. Property and Demographic Database Exposes 200 Million Records

]

[8]

European Central Bank

Cash remains the most frequently used means of payment in stores but electronic payments grow further, ECB study shows

The European Central Bank (ECB) is the central bank of the European Union countries which have adopted the euro. Our main task is to maintain price...

[9]

Weekly Gold Price in USD Per Kilo | Chards

Track the live price of gold in US dollars per kilo using our fast loading gold price chart.

[10]

Bitcoin Magazine

China's Latest Bitcoin "Ban" Is Impacting Mining, Exchange Landscape

The latest efforts in China to regulate Bitcoin seems to be having a significant effect on mining and exchange businesses.

[11]

Bitcoin Magazine

Why China’s Ban Was The Best Thing For Bitcoin In 2021

The latest ban on Bitcoin activity in China generated negative headlines in 2021 but looking back, it was the best thing that could have happened l...

[12]

Method of loci - Wikipedia

[13]

Check your wallet backup (recovery seed) backup for the Trezor Model T

Learn how to verify your wallet backup on the Trezor Model T hardware wallet using Trezor Suite. This guide provides step-by-step instructions to e...

[14]

Metal Bitcoin Seed Storage Reviews

Stress tests and reviews of seed storage devices.

[15]

https://support.signal.org/hc/en-us/articles/360007318911-How-do-I-know-my-communication-is-private-#:~:text=Signal%20messages%20and%20calls%20cannot,encrypted%2C%20private%2C%20and%20secure.

[16]

Kaspersky official blog

Kaspersky official blog

The Official Blog from Kaspersky covers information to help protect you against viruses, spyware, hackers, spam & other forms of malware.

.

[17]

What is a passphrase? | Trezor Knowledge Base

Passphrases on Trezor devices generate independent wallets based on your recovery seed and chosen phrase. Learn how they work and what to consider ...

[18]

Bitcoin Magazine

Crypto Exchange FTX Files For Bankruptcy, CEO Resigns

FTX Group, which includes FTX U.S., filed for Chapter 11 bankruptcy following an intense liquidity crisis; CEO Sam Bankman-Fried stepped down.

[19]

Bitcoin Magazine

Celsius Bankruptcy Shows Reckless Behavior With A $1.2 Billion Hole In Its Balance Sheet

Celsius files for Chapter 11 bankruptcy. The company’s balance sheet shows a gap of $1.2 billion and reckless behavior with customer deposits.

[20]

Bitcoin Magazine

Crypto Lender BlockFi Files For Bankruptcy

The filing indicates that the firm could have up to $10 billion in liabilities, as contagion from FTX spreads.

[21]

https://blockworks.co/news/gemini-earn-users-lose-savings

[22]

Bitcoin Magazine

Finding Financial Freedom In Afghanistan

A pioneering female CEO has been promoting Bitcoin in Afghanistan since 2013 and sees it needed in her home country now more than ever.

[23]

Opinion | Bitcoin Has Saved My Family (Published 2019)

“Borderless money” is more than a buzzword when you live in a collapsing economy and a collapsing dictatorship.

[24]

CNBC

Ukrainian refugee flees to Poland with $2,000 in bitcoin on a USB drive

Nearly a quarter of Ukraine's population has been forced from their homes in the last four weeks. Many have turned to cryptocurrency.

Dr. Saifedean Ammous, prominent economist and author of "The Bitcoin Standard," is poised to take on a new role as an Economic Advisor to El Salvador's Bitcoin Office. This appointment comes after El Salvador made history by becoming the first country to adopt bitcoin as legal tender [1] in September 2021.

“Having Saifedean Ammous on team El Salvador is fantastic,” Max Keiser, Senior Bitcoin Advisor to the country said in a statement to Bitcoin Magazine. “Ammous brilliantly captured the role of Bitcoin as, ‘The alternative to Central Banking’ in his now classic, ‘The Bitcoin Standard’ as well as the philosophy of Bitcoin including popularizing the idea of 'time preference' as a life-hack. This news makes me very happy.”

Ammous, known for his expertise in Bitcoin and monetary economics, is expected to provide valuable guidance and insights to the Bitcoin Office as it navigates the implementation and integration of Bitcoin into the country's economy. His extensive knowledge and research on the subject have earned him recognition within the community and beyond.

The Bitcoin Law, proposed by El Salvador's President Nayib Bukele and approved by the Legislative Assembly, has set the stage for a new era in the country's financial landscape. With Ammous joining as an Economic Advisor, El Salvador aims to leverage his expertise to maximize the benefits and address potential challenges associated with adopting bitcoin as legal tender.

The Bitcoin Office, established to oversee the implementation of the Bitcoin Law, will likely benefit from Ammous' insights on monetary policy, sound money principles and the potential economic implications of embracing a decentralized digital currency. His appointment signals El Salvador's commitment to incorporating expert opinions into their strategy and decision-making process.

Links:

[1]

Dr. Saifedean Ammous, prominent economist and author of "The Bitcoin Standard," is poised to take on a new role as an Economic Advisor to El Salvador's Bitcoin Office. This appointment comes after El Salvador made history by becoming the first country to adopt bitcoin as legal tender [1] in September 2021.

“Having Saifedean Ammous on team El Salvador is fantastic,” Max Keiser, Senior Bitcoin Advisor to the country said in a statement to Bitcoin Magazine. “Ammous brilliantly captured the role of Bitcoin as, ‘The alternative to Central Banking’ in his now classic, ‘The Bitcoin Standard’ as well as the philosophy of Bitcoin including popularizing the idea of 'time preference' as a life-hack. This news makes me very happy.”

Ammous, known for his expertise in Bitcoin and monetary economics, is expected to provide valuable guidance and insights to the Bitcoin Office as it navigates the implementation and integration of Bitcoin into the country's economy. His extensive knowledge and research on the subject have earned him recognition within the community and beyond.

The Bitcoin Law, proposed by El Salvador's President Nayib Bukele and approved by the Legislative Assembly, has set the stage for a new era in the country's financial landscape. With Ammous joining as an Economic Advisor, El Salvador aims to leverage his expertise to maximize the benefits and address potential challenges associated with adopting bitcoin as legal tender.

The Bitcoin Office, established to oversee the implementation of the Bitcoin Law, will likely benefit from Ammous' insights on monetary policy, sound money principles and the potential economic implications of embracing a decentralized digital currency. His appointment signals El Salvador's commitment to incorporating expert opinions into their strategy and decision-making process.

Links:

[1]

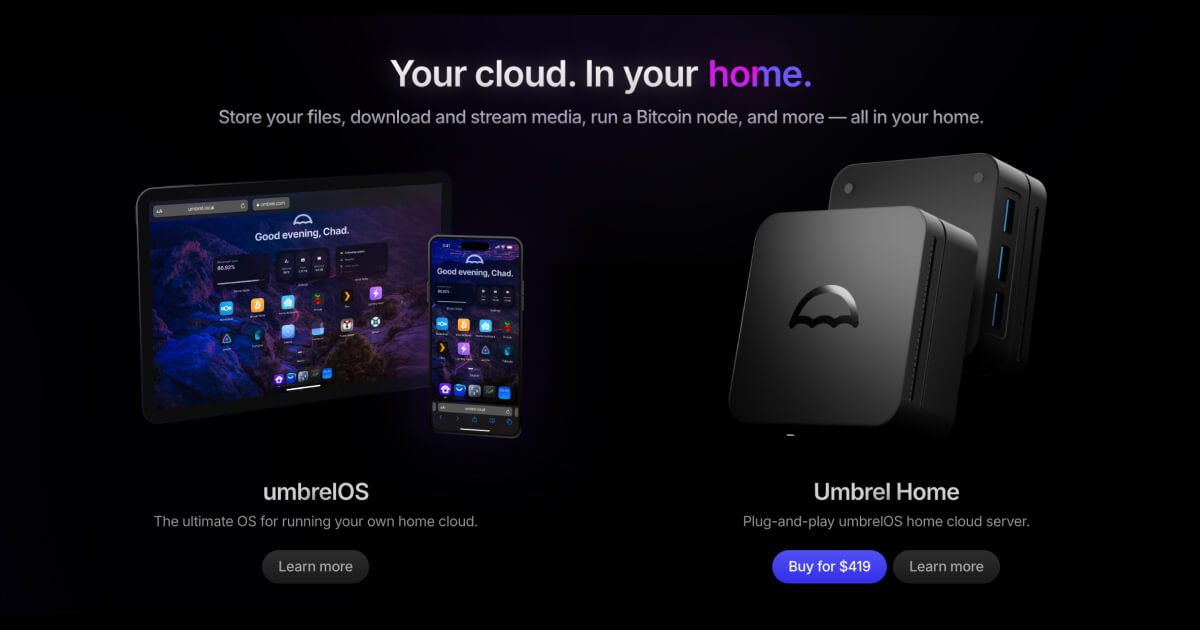

According to the press release, Umbrel Home offers accelerated performance, featuring a 2.9GHz Quad-Core Intel CPU, 2TB NVMe SSD, 16GB dual-channel RAM, and an active cooling system while consuming just 10 watts of power. This compact home server outperforms a Raspberry Pi 4-based solution in terms of CPU performance, SSD read and write speeds, RAM and memory bandwidth the release states.

Mayank Chhabra, Umbrel's Co-founder and CEO, highlighted the company's vision for Umbrel Home, saying that "Building a plug-and-play home server that was specifically engineered for umbrelOS has been our dream since day one. With the recent challenges in Raspberry Pi pricing and supply chain, we knew it was time to bring our vision to life, set a new benchmark in self-hosting, and make it accessible to users of all skill levels."

With privacy and data ownership concerns on the rise, self-hosting presents a modern solution that allows users to take ownership of their data, storage, access and sharing. In addition, Umbrel Home’s zero-configuration and one-click app installations from the Umbrel App Store make it easy to build a customized ecosystem tailored to individual needs.

Pre-orders for Umbrel Home are now available on umbrel.com, with shipping set to begin in June 2023. With its exceptional performance, user-friendly features and affordability, Umbrel Home aims to make self-hosting accessible to a global audience.

Links:

[1]

According to the press release, Umbrel Home offers accelerated performance, featuring a 2.9GHz Quad-Core Intel CPU, 2TB NVMe SSD, 16GB dual-channel RAM, and an active cooling system while consuming just 10 watts of power. This compact home server outperforms a Raspberry Pi 4-based solution in terms of CPU performance, SSD read and write speeds, RAM and memory bandwidth the release states.

Mayank Chhabra, Umbrel's Co-founder and CEO, highlighted the company's vision for Umbrel Home, saying that "Building a plug-and-play home server that was specifically engineered for umbrelOS has been our dream since day one. With the recent challenges in Raspberry Pi pricing and supply chain, we knew it was time to bring our vision to life, set a new benchmark in self-hosting, and make it accessible to users of all skill levels."

With privacy and data ownership concerns on the rise, self-hosting presents a modern solution that allows users to take ownership of their data, storage, access and sharing. In addition, Umbrel Home’s zero-configuration and one-click app installations from the Umbrel App Store make it easy to build a customized ecosystem tailored to individual needs.

Pre-orders for Umbrel Home are now available on umbrel.com, with shipping set to begin in June 2023. With its exceptional performance, user-friendly features and affordability, Umbrel Home aims to make self-hosting accessible to a global audience.

Links:

[1]

Source:

Source: