Accounting for the run up in 2017, 2021, and ordinals of 2023-2024 we’ve had 294 days with a median bitcoin transaction fee of over $5.

Where do you count the start of the Bitcoin network? Someone used it to buy pizza 5/22/2010. Using that as a starting point, median bitcoin fees have been below $5 for ~95% of its life

Over the last 3 years the median bitcoin transaction fee per day was over $5 for 68 days, or ~6% of that total period

My Uber driver in STL told me about bitcoin’s finite supply

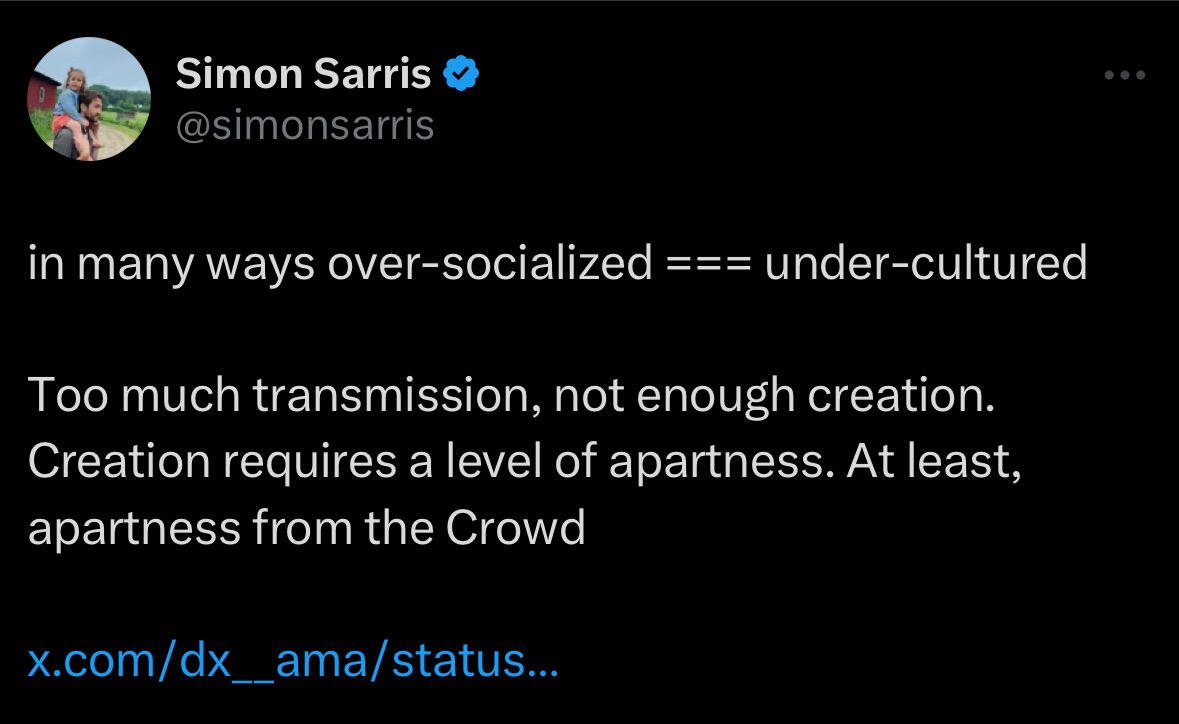

It is low risk to do what other people are doing. You have the small proof point that someone threw money at it and maybe even can see some success. Following this path though, and constantly following is a sure fire way to not have a plan or vision. You may achieve some success, but you’ll need to look to the other guy for what’s next.

Mapping out a path to what you want the world to look like, or in other words, setting a vision can be high risk (or at least seen as high risk to someone who values always being right). We are not good at predicting the future, but I think we deceive ourselves about how good we are at making the future.

Having the right principles and values, and an idea of where you want to go means that every small decision along the way pushes you closer to where you want to be. Setting a vision is a bit like a self-fulfilling prophecy. It may be hard, the path there may not be exactly what you think it’ll be, but if you have the plan and the vision in mind, every step will bring you closer.

And if you’re wrong, and you’re smart about it, you’ll adjust. Again, very few people predict the next 10 years.

What matters when setting vision and direction are the underlying principles, motives, hypotheses, and not 100% the object level.

There’s a phenomenon I’ve noticed since getting involved professionally with Bitcoin, and I suspect it happens in other industries as well. I have a pet hypothesis is it drives most tech fads.

I like to think of it as the “VC information super highway.” Of course VCs are looking for the latest thing to invest in, and talk to a lot of people. Eventually you find ideas that make the rounds of these VC charged networks.

What I’ve noticed about most of the ideas that come to me this way:

- they’re already being done, and copied

- they’re an indicator of what is in vogue among VCs, and could likely be a fad / bubble

- if you’re acting on this information alone, you’re likely not doing it right

What’s “it”? It’s looking at what you have, what’s out there, and what you can do and charting a path forward that best harnesses your strengths and opportunities.

Said another way, if you’re always doing what’s already out there, you will be by definition, perpetually behind. No idea is born in a vacuum, but if you’re not generating original thought within your own context, you are doing yourself a disservice. What might be working for one person, or company may very well not be what will work for you.

It’s cool to hear what people are doing, but it was a mistake to make 3D TVs, double down on IoT, have a VR play, have an AI play.

It sounds contrarian, but there is a lot of value in sticking to what you know deeply and your own principles. Doing what everyone else is doing is generally a losing or fleeting proposition.

Mempool 7 sat/vb

Bitkey $25

👀

The Supreme Court has been doing work defending the constitution

Worldcoin guy still worldcoining huh