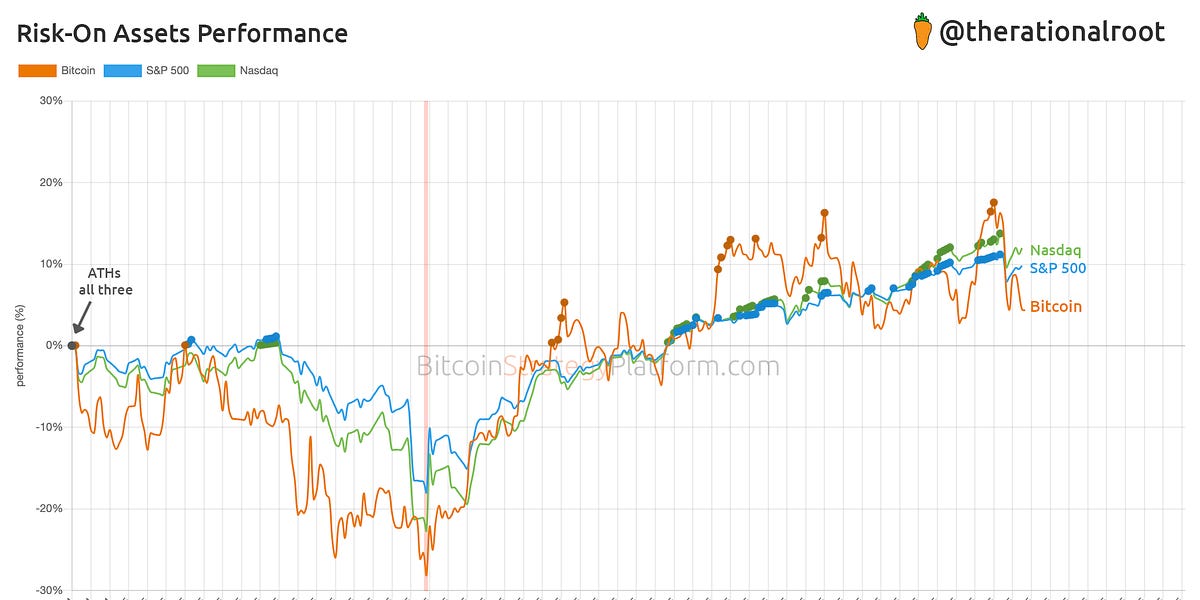

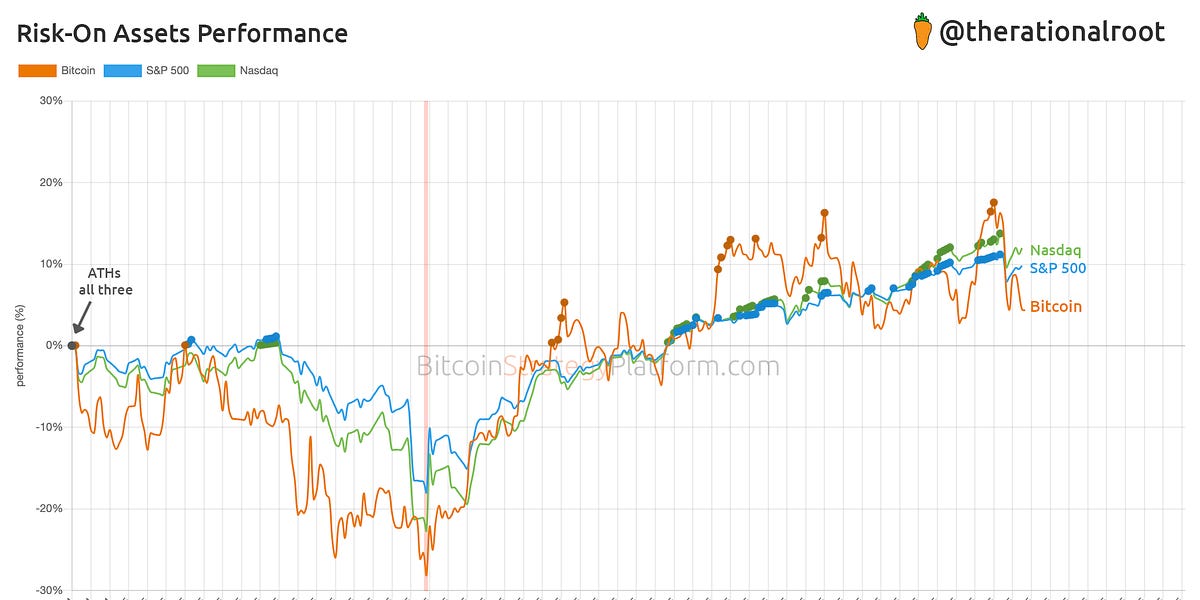

Bitcoin crashing further: price action, market structure, and whether gold is telling us where Bitcoin is heading next.

Read today’s Bitcoin Strategy newsletter 👇

Market Analysis: Is Gold Telling Where Bitcoin Is Going?

Bitcoin Crashing Further: Price Action and Market Structure